Notice of China Banking and Insurance Regulatory Commission Municipality on Printing and Distributing the Measures for Capital Management of Financial Asset Investment Companies (Trial) Measures for C

China Banking and Insurance Regulatory Commission on printing and distributing financial assets investment companies

Notice of Measures for Capital Management (for Trial Implementation)

Yin Bao Jian Gui [2022] No.12

All banking insurance regulatory bureaus, Industrial and Commercial Bank of China, Agricultural Bank of China, China Bank, China Construction Bank, Bank of Communications, and all financial asset investment companies:

"Measures for Capital Management of Financial Asset Investment Companies (Trial)" has been adopted at the second ministerial meeting in China Banking and Insurance Regulatory Commission in 2022, and is hereby issued to you, please follow it.

China Banking and Insurance Regulatory Commission

June 17, 2022

Measures for capital management of financial asset investment companies (for Trial Implementation)

Chapter I General Principles

the first In order to strengthen the capital supervision of financial asset investment companies and promote the stable operation of financial asset investment companies, these Measures are formulated in accordance with the Banking Supervision Law of the People’s Republic of China, the Administrative Measures for Financial Asset Investment Companies (Trial) (Order No.4 of the Bank of China Insurance Regulatory Commission in 2018) and other laws and regulations.

the second These Measures shall apply to groups composed of financial asset investment companies and their subsidiaries.

The term "financial asset investment company" as mentioned in these Measures refers to a non-bank financial institution established within the territory of People’s Republic of China (PRC) with the approval of China Banking and Insurance Regulatory Commission, which is mainly engaged in bank debt-to-equity swap (hereinafter referred to as debt-to-equity swap) and supporting business. The term "affiliated institutions" as mentioned in these Measures refers to institutions that are directly or indirectly held by financial asset investment companies and should be included in the scope of consolidated capital supervision in accordance with the provisions of Section V of Chapter II of these Measures.

Article A financial asset investment company shall ensure that the capital it holds can withstand the risks it faces, including group risks, individual risks and systemic risks.

Article 4 A financial asset investment company shall continuously meet the regulatory requirements and indicators of capital adequacy as stipulated in these Measures.

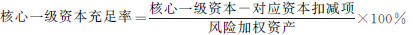

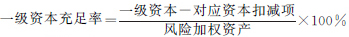

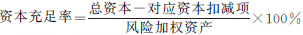

Article 5 The term "capital adequacy ratio" as mentioned in these Measures refers to the ratio between capital and risk-weighted assets held by financial asset investment companies that meet the requirements of these Measures.

Tier 1 capital adequacy ratio refers to the ratio between tier 1 capital and risk-weighted assets held by financial asset investment companies that meet the requirements of these Measures.

Core Tier 1 capital adequacy ratio refers to the ratio between core Tier 1 capital and risk-weighted assets held by financial asset investment companies that meet the requirements of these Measures.

Article 6 A financial asset investment company shall calculate the consolidated and non-consolidated capital adequacy ratio in accordance with the provisions of these Measures.

Article 7 The term "net capital" as mentioned in these Measures refers to the capital balance after deduction from all levels of capital held by financial asset investment companies and affiliated institutions that meet the provisions of these Measures.

Article 8 In addition to the above regulatory requirements for capital adequacy ratio, financial asset investment companies should also meet the regulatory requirements for leverage ratio.

The term "leverage ratio" as mentioned in these Measures refers to the ratio between the net Tier 1 capital held by a financial asset investment company and the adjusted balance of assets on the balance sheet and the balance of off-balance sheet items.

Article 9 A financial asset investment company shall establish a comprehensive risk management framework and internal capital adequacy management and evaluation procedures.

Article 10 China Banking and Insurance Regulatory Commission and its dispatched offices shall, in accordance with these Measures, conduct daily supervision and on-site inspection on the capital adequacy and capital management of financial asset investment companies, and may take corresponding supervision measures as appropriate.

Chapter II Capital Supervision Requirements

Section 1 Calculation of Capital Adequacy Ratio and Regulatory Requirements

Article 11 The formula for calculating the capital adequacy ratio of a financial asset investment company is:

Article 12 The total capital of a financial asset investment company includes core tier 1 capital, other tier 1 capital and tier 2 capital. A financial asset investment company shall calculate all levels of capital and deductions in accordance with the provisions of Section II of this chapter.

Article 13 The risk-weighted assets of financial asset investment companies include credit risk-weighted assets, market risk-weighted assets, operational risk-weighted assets and asset management business risk-weighted assets. A financial asset investment company shall separately measure credit risk-weighted assets, market risk-weighted assets, operational risk-weighted assets and asset management business risk-weighted assets in accordance with the provisions of Section III of this chapter.

Article 14 The capital adequacy ratio of financial asset investment companies at all levels shall not be lower than the following requirements:

(1) The core tier-one capital adequacy ratio shall not be less than 5%;

(2) The Tier 1 capital adequacy ratio shall not be less than 6%;

(3) The capital adequacy ratio shall not be less than 8%.

Article 15 Under certain circumstances, a financial asset investment company shall accrue countercyclical capital above the minimum capital requirement. The countercyclical capital requirement is 0-2.5% of risk-weighted assets, which is met by core Tier 1 capital. The countercyclical capital requirement is determined by China Banking and Insurance Regulatory Commission according to the actual situation.

Section 2 Definition of Capital

Article 16 Core Tier 1 capital includes:

(1) Paid-in capital or common stock;

(2) Capital reserve;

(3) Surplus reserve;

(4) General risk preparation;

(5) Undistributed profits;

(6) Other parts that can be included.

Article 17 Other Tier 1 capital includes:

(1) Other Tier 1 capital instruments;

(2) Premium of other Tier 1 capital instruments.

Article 18 Tier 2 capital includes:

(1) Tier 2 capital instruments;

(2) Premium of secondary capital instruments;

(3) Reserve for excess losses.

Financial asset investment companies should use the weight method to measure credit risk-weighted assets, and the excess loss reserve can be included in tier 2 capital, but it shall not exceed 1.25% of credit risk-weighted assets.

A financial asset investment company shall carry out impairment accounting treatment on financial instruments that need impairment accounting treatment in strict accordance with the requirements of accounting standards and confirm the loss reserve. The excess loss reserve mentioned in the preceding paragraph refers to the part of the loss reserve actually withdrawn by a financial asset investment company that exceeds the balance of non-performing assets.

Article 19 When calculating the capital adequacy ratio, a financial asset investment company shall fully deduct the following items from the core Tier 1 capital:

(1) Goodwill;

(2) Other intangible assets (except land use rights);

(3) Net deferred income tax assets caused by operating losses;

(4) The gap of loss provision for credit risk assets.

The gap of loss reserve refers to the part where the loss reserve actually accrued by a financial asset investment company is lower than the balance of non-performing assets.

Article 20 Capital instruments at all levels held by financial asset investment companies and other financial institutions through agreements, or capital investments at all levels identified by China Banking and Insurance Regulatory Commission and its dispatched offices as inflated capital, should be deducted from the corresponding regulatory capital.

Financial asset investment companies directly or indirectly hold capital instruments at all levels issued by the company, which should be deducted from the corresponding regulatory capital. Financial asset investment companies should deduct the capital investment in affiliated institutions from the capital at all levels when calculating the capital adequacy ratio without consolidation.

Corresponding deduction refers to a one-time full deduction from the corresponding capital of the financial asset investment company. If the net capital of a financial asset investment company at a certain level is less than the amount to be deducted, the gap shall be deducted from the net capital at a higher level.

Article 21 The small minority capital investment made by a financial asset investment company to financial institutions that are not included in the scope of capital supervision, which exceeds 30% of the company’s core tier-one net capital, shall be deducted from the supervision capital at all levels.

Small minority capital investment refers to the capital investment (including direct and indirect investment) of a financial asset investment company to all levels of financial institutions, which accounts for less than 10% (excluding) of the paid-in capital (common stock plus common stock premium) of the invested financial institution, and can be excluded from the scope of capital supervision according to the provisions of Section 5 of this chapter.

Article 22 Among the large minority capital investments made by financial asset investment companies to financial institutions that are not included in the scope of capital supervision, the part where the total core tier-one capital investment exceeds 30% of the company’s net core tier-one capital shall be deducted from the company’s core tier-one capital; Other tier-1 capital investments and tier-2 capital investments shall be fully deducted from the corresponding level of capital.

Large minority capital investment refers to the capital investment (including direct and indirect investment) made by a financial asset investment company to all levels of financial institutions, which accounts for more than 10% (inclusive) of the paid-in capital (common stock plus common stock premium) of the invested financial institution, and may not be included in the scope of capital supervision according to the provisions of Section 5 of this chapter.

Article 23 Except for the net deferred income tax assets specified in Article 19 of these Measures, other net deferred income tax assets that depend on the company’s future earnings, which exceed 10% of the company’s net core tier 1 capital, shall be deducted from the core tier 1 capital.

Article 24 According to the provisions of Article 22 and Article 23 of these Measures, the total amount of large minority capital investment in financial institutions and the corresponding net deferred income tax assets not deducted from the core tier 1 capital of a financial asset investment company shall not exceed 35% of the company’s net core tier 1 capital.

Section 3 Measurement of Risk-weighted Assets

Article 25 Financial asset investment companies use the weight method to measure credit risk-weighted assets.

Article 26 When measuring the risk-weighted assets of various on-balance-sheet assets, a financial asset investment company should first deduct the corresponding impairment reserve from the book value of the assets, and then multiply it by the risk weight.

A financial asset investment company shall measure the credit risk-weighted assets of various on-balance-sheet assets in accordance with the provisions of Annex 1 to these Measures.

Article 27 When a financial asset investment company uses the weighting method to measure credit risk-weighted assets, it may consider the risk mitigation effect of the risk mitigation clause in accordance with the provisions in Annex 1 of these Measures, and the calculation method is as follows:

Credit risk weighted assets = (book value of assets-impairment reserve-book value of risk mitigation tools) × risk weight of assets+book value of risk mitigation tools× risk weight of risk mitigation tools.

Article 28 Financial asset investment companies should adopt the standard method to measure the market risk capital requirements.

Article 29 A financial asset investment company shall formulate clear criteria for the division of trading books and bank books, specify the positions of financial instruments included in trading books and the conditions for transfer between trading books and bank books, and ensure the consistency of implementation.

Article 30 The market risk-weighted assets of financial asset investment companies are 12.5 times of the market risk capital requirements, that is, market risk-weighted assets = market risk capital requirements ×12.5.

Article 31 A financial asset investment company shall separately measure the capital requirements of various asset market risks in accordance with the provisions of Annex 2 to these Measures.

Article 32 Financial asset investment companies should adopt the basic index method to measure the operational risk capital requirements.

Article 33 The operational risk-weighted assets of financial asset investment companies are 12.5 times of the operational risk capital requirements, that is, operational risk-weighted assets = operational risk capital requirements ×12.5.

Article 34 A financial asset investment company shall measure the operational risk capital requirements based on the average total income in the last three years.

Total income shall be confirmed in accordance with the provisions of Annex 3 of these Measures, including investment income, net fee and commission income, net interest income, net income from disposal of non-performing assets and other income.

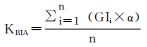

Operational risk capital shall be measured according to the following formula:

Among them:

KBIAIt is the operational risk capital requirement measured by the basic index method;

GI is the positive total income in each of the past three years;

N is the number of years with positive total income in the past three years;

α is 15%.

Article 35 Financial asset investment companies should measure the risk capital requirements of asset management business.

Article 36 The risk-weighted assets of the asset management business of a financial asset investment company are 12.5 times the risk capital requirement of the asset management business, that is, the risk-weighted assets of the asset management business = the risk capital requirement of the asset management business ×12.5.

Article 37 A financial asset investment company shall measure the risk capital requirements of asset management business in accordance with the provisions of Annex 4 of these Measures.

Article 38 A financial asset investment company shall carefully judge the risk situation faced by its asset management business and ensure that the capital can cover the risk of asset management business.

Section 4 Calculation of Leverage Ratio and Regulatory Requirements

Article 39 The formula for calculating the leverage ratio of a financial asset investment company is:

Leverage ratio = net Tier 1 capital/(adjusted balance of on-balance-sheet assets+balance of off-balance-sheet items) ×100%

Article 40 The adjusted balance of on-balance-sheet assets is the balance of on-balance-sheet assets after deducting Tier 1 capital deduction from the total assets in the table.

Article 41 Off-balance sheet items do not include asset management business. The balance of off-balance-sheet items is the risk exposure calculated by the off-balance-sheet business of financial asset investment companies according to the corresponding credit conversion coefficient, and the credit conversion coefficient of various off-balance-sheet items shall be implemented in accordance with Annex 5 of these Measures.

Article 42 The leverage ratio of a financial asset investment company shall not be less than 6%.

Section 5 Calculation Scope of Consolidated Capital Supervision Indicators

Article 43 The calculation scope of consolidated capital supervision indicators shall include financial asset investment companies and institutions that directly or indirectly invest in them in accordance with the provisions of these Measures.

Article 44 A financial asset investment company shall follow the principle of "substance is more important than form", take control as the basis, and take into account the risk correlation, and include the invested institutions that meet one of the following conditions into the consolidated calculation scope:

(1) The investee directly owned by the financial asset investment company or its affiliated institutions, or jointly owned by the financial asset investment company and its affiliated institutions with more than 50% of the voting rights.

(2) An investee whose financial asset investment company has less than 50% of the voting rights, but is under any of the following circumstances:

1. Having more than 50% of the voting rights of the institution through agreements with other investors;

2. According to the articles of association or agreement, have the right to decide the financial and operating policies of the institution;

3. Have the right to appoint or remove most members of the board of directors of the institution or similar authority;

4. Have a majority of voting rights in the board of directors of the institution or similar authority.

When determining the voting right of the invested institution, we should consider the potential voting factors such as the current convertible corporate bonds and current executable warrants held by the financial asset investment company. The potential voting rights that can be realized in the current period shall be included in the voting rights of the financial asset investment company to the invested institution.

(3) There is other evidence that the invested institution is actually controlled by the financial asset investment company.

Control means that the investor has the power over the investee, enjoys variable returns by participating in the related activities of the investee, and has the ability to influence the amount of returns by using the power over the investee.

Article 45 A financial asset investment company does not have the majority voting rights or control rights of the invested institution, and it shall be included in the calculation range of consolidated capital supervision indicators under any of the following circumstances:

(1) Although the asset size of a single institution accounts for a small proportion of the overall asset size of a financial asset investment company, according to the risk correlation, the overall risk of such institutions is enough to have a significant impact on the financial position and risk level of a financial asset investment company;

(2) The harm and loss caused by the compliance risk and reputation risk of the invested institution are sufficient to have a significant impact on the financial asset investment company.

Article 46 The following invested institutions may not be included in the calculation scope of consolidated capital supervision indicators:

(a) closed or declared bankrupt institutions;

(2) Institutions that have entered liquidation procedures due to termination;

(3) Invested institutions that have evidence to prove that they have decided to sell within three years, and the equity capital of financial asset investment companies or affiliated institutions is more than 50%;

(4) A subsidiary non-financial institution that meets any of the following conditions:

1. The proportion of financial assets in total assets is less than 50% (the scope of financial assets shall conform to the relevant provisions of Accounting Standards for Enterprises No.22-Recognition and Measurement of Financial Instruments);

2. The asset-liability ratio is lower than 70%;

3. It is recognized by China Banking and Insurance Regulatory Commission and its agencies that it has no investment and financing function.

The conditions stipulated in this paragraph are mainly judged according to the arithmetic average of the audited year-end financial statements of the affiliated non-financial institution in the last two years. If it is established less than two years, it can be judged according to the audited financial statements from the date of establishment to the latest period.

Article 47 If a financial asset investment company and its affiliated financial institutions provide long-term repayment guarantee to affiliated non-financial institutions, the non-financial institutions shall be included in the scope of capital supervision; If there is no repayment guarantee or the repayment guarantee can be unconditionally revoked, the financial asset investment company shall handle it according to the principle of prudence. Equity investment through structured entities such as asset management plans and funds should be managed according to the penetrating principle.

Article 48 A financial asset investment company shall strengthen the capital management of its subsidiaries, determine the management requirements for the capital adequacy of its subsidiaries at all levels according to its actual situation, and urge the subsidiaries to continuously meet the capital management and supervision requirements.

Article 49 China Banking and Insurance Regulatory Commission and its dispatched offices have the right to determine and adjust the scope of capital supervision according to the changes in equity structure and risk categories of financial asset investment companies and their investment institutions.

Chapter III Internal Capital Adequacy Assessment Procedures

Article 50 A financial asset investment company shall, in accordance with the regulatory requirements, establish a sound risk management framework and a robust internal capital adequacy assessment procedure, clarify the risk governance structure, carefully assess various risks, capital adequacy levels and capital quality, and formulate capital planning and capital management plans to ensure that capital can fully resist the risks it faces and meet the needs of business development.

Article 51 The board of directors of a financial asset investment company bears the primary responsibility for capital management of the company. The board of directors shall perform the following duties:

(1) Set the risk preference and capital adequacy target suitable for the company’s development strategy and external environment, and examine and approve the internal capital adequacy assessment procedures to ensure that the capital fully covers the major risks.

(2) Examining and approving the company’s capital management system, and ensuring that the capital management policies and control measures are effective.

(3) Examining and approving and supervising the implementation of capital planning. Examine and approve the capital management plan at least once a year, review the capital management report and the internal capital adequacy assessment report, and listen to the audit report on the implementation of the capital management and internal capital adequacy assessment procedures.

(4) Examining and approving the policies, procedures and contents of capital information disclosure, and ensuring the truthfulness, accuracy and completeness of the disclosed information.

(five) to ensure that financial asset investment companies have sufficient resources to independently and effectively carry out capital management.

Article 52 When making a capital plan, a financial asset investment company shall comprehensively consider the results of risk assessment, stress test, future capital demand, capital regulatory requirements and capital availability to ensure that the capital level continuously meets the regulatory requirements. Capital planning should set at least a three-year target of internal capital level.

Article 53 A financial asset investment company shall improve its reporting system, regularly monitor and report the changing trend of the company’s capital level and main influencing factors, and the report shall at least include the following contents:

(1) Assessing the impact of major risks and development trends, strategic objectives and external environment on the capital level;

(2) Assessing whether the capital actually held is sufficient to resist major risks;

(3) Put forward suggestions to ensure that capital can fully cover major risks.

According to the different importance and purpose of the report, a financial asset investment company shall specify the sending scope, contents and details of all kinds of reports, and ensure that the reporting information and frequency meet the needs of the capital management of the financial asset investment company.

A financial asset investment company shall submit a report on capital management and internal capital adequacy assessment to China Banking and Insurance Regulatory Commission within four months after the end of the year.

Chapter IV Supervision and Administration

Article 54 China Banking and Insurance Regulatory Commission and its agencies shall supervise and inspect the capital adequacy of financial asset investment companies to ensure that the capital can fully cover all kinds of risks.

Article 55 China Banking and Insurance Regulatory Commission and its dispatched offices have the right to put forward more prudent additional capital requirements according to the daily supervision and on-site inspection to ensure that the capital fully covers risks, including:

(a) according to the function orientation of a single financial asset investment company, the implementation of development strategy, the operation and development of debt-to-equity swap, etc., the additional capital requirements put forward;

(2) According to the judgment of the risk of a specific asset portfolio and its relevance to the main business, the additional capital requirements for a specific asset portfolio are put forward by adjusting the risk weight and other methods;

(3) According to the fact that a single financial asset investment company has not established an internal capital adequacy assessment procedure, or the internal capital adequacy assessment procedure fails to meet the relevant requirements, combined with the assessment results of the risk situation, the additional capital requirements are put forward for the financial asset investment company;

(4) According to the operational risk management level of a single financial asset investment company and the occurrence of operational risk events, the additional capital requirements for operational risk put forward by the financial asset investment company;

(five) according to the results of supervision and inspection, the additional capital requirements for financial asset investment companies.

Article 56 According to the capital adequacy, China Banking and Insurance Regulatory Commission and its agencies will be divided into three categories of financial asset investment companies:

(1) Class I financial asset investment companies: the capital adequacy ratio, tier 1 capital adequacy ratio and core tier 1 capital adequacy ratio all meet the capital requirements at all levels as stipulated in these Measures.

(2) Type II financial asset investment companies: the capital adequacy ratio, tier 1 capital adequacy ratio and core tier 1 capital adequacy ratio are not lower than the minimum capital requirements and countercyclical capital requirements, but any one of them fails to meet the additional capital requirements.

(3) Category III financial asset investment companies: any one of the capital adequacy ratio, tier 1 capital adequacy ratio and core tier 1 capital adequacy ratio fails to meet the minimum capital requirements and countercyclical capital requirements.

Article 57 For the first type of financial asset investment companies, in order to prevent the rapid decline of their capital adequacy level, China Banking and Insurance Regulatory Commission and its dispatched offices may put forward the following regulatory requirements:

(a) to strengthen the analysis and prediction of the reasons for the decline in the level of capital adequacy;

(2) Formulating a feasible capital adequacy management plan;

(3) Improve risk control capability.

Article 58 For the second kind of financial asset investment companies, in addition to the regulatory measures stipulated in Article 57 of these Measures, China Banking and Insurance Regulatory Commission can also take the following regulatory measures according to law according to different situations:

(1) Prudent talks with the board of directors and senior management of the financial asset investment company.

(2) Issuing supervision opinions, including: problems existing in capital management, corrective measures to be taken, and opinions on meeting the standards within a time limit, etc.

(3) Require financial asset investment companies to formulate feasible capital replenishment plans and plans to meet the standards within a time limit.

(4) Increase the frequency of supervision and inspection on the capital adequacy of financial asset investment companies.

(5) Require financial asset investment companies to take risk mitigation measures in specific risk areas.

Article 59 For the third kind of financial asset investment companies, in addition to the regulatory measures stipulated in Articles 57 and 58 of these Measures, China Banking and Insurance Regulatory Commission can also take the following regulatory measures according to law according to different situations:

(1) Restrict financial asset investment companies from distributing dividends and other income. Dividends and other income include: items that can be used for profit distribution, stock repurchase, independent income from other Tier 1 capital instruments and independent payment to employees.

(2) Restrict financial asset investment companies from offering any form of incentives to directors and senior managers.

(3) Restrict financial asset investment companies from making equity investments or repurchasing capital instruments.

(four) to limit the important capital expenditure of financial asset investment companies.

(5) Require financial asset investment companies to control the growth of risky assets.

When dealing with such financial asset investment companies, China Banking and Insurance Regulatory Commission can also take other necessary measures in consideration of external factors.

Article 60 For financial asset investment companies whose leverage ratio is lower than the minimum regulatory requirements, China Banking and Insurance Regulatory Commission can put forward the following regulatory requirements:

(1) Replenishing Tier 1 capital within a limited period;

(2) Controlling the growth rate of assets on and off the balance sheet;

(3) Reduce the scale of off-balance-sheet assets.

Chapter V Information Disclosure

Article 61 A financial asset investment company shall disclose information related to capital adequacy to investors and the public through open channels to ensure the centralization, accessibility and openness of information disclosure.

Article 62 The frequency of information disclosure of financial asset investment companies is divided into temporary, semi-annual and annual disclosures. Among them, temporary information shall be disclosed in a timely manner, and the semi-annual information disclosure time shall be within the last 60 working days and the annual information disclosure time shall be within four months after the end of the fiscal year. If it cannot be disclosed on time due to special reasons, it shall apply to China Banking and Insurance Regulatory Commission and its dispatched offices for delayed disclosure at least 15 working days in advance.

Article 63 A financial asset investment company shall disclose relevant information at the following frequency:

(1) Changes in paid-in capital or common stock and other capital instruments shall be disclosed in a timely manner.

(2) Important information such as net core tier-one capital, net tier-one capital, net capital, core tier-one capital adequacy ratio, tier-one capital adequacy ratio, capital adequacy ratio and leverage ratio shall be disclosed once every six months.

(3) Relevant important information such as the calculation range of capital adequacy related indicators, total credit risk exposure, total non-performing assets, provision for impairment of credit risk assets, risk exposure balance after slow release of credit risk portfolio, market risk, operational risk, asset management business risk and debt-to-equity swap business risk shall be disclosed once a year.

Article 64 With the consent of China Banking and Insurance Regulatory Commission, the content of information disclosure can be appropriately simplified on the basis of meeting the overall requirements of information disclosure.

Chapter VI Supplementary Provisions

Article 65 China Banking and Insurance Regulatory Commission is responsible for the interpretation of these measures.

Article 66 These Measures shall come into force as of the date of issuance.

Attachment: 1. Assets credit risk weight in the balance sheet and risk mitigation tools for qualified equity investment.

2. Measurement rules of market risk standard method

3. Measurement rules of basic index method of operational risk

4. Risk capital measurement rules for asset management business

5. Credit conversion coefficient of off-balance sheet items

(The above attachment is omitted, please visit the website of China Banking and Insurance Regulatory Commission for details.)