Gree Bo’s performance in the first year of listing "changed face", can the "returnees" boss increase his holdings?

Stock trading depends on Jin Qilin analyst research report, which is authoritative, professional, timely and comprehensive, and helps you tap the potential theme opportunities!

Source: Yema Finance

What happened to "the first share of new energy garden machinery"?

The first report card after listing made investors very dissatisfied.

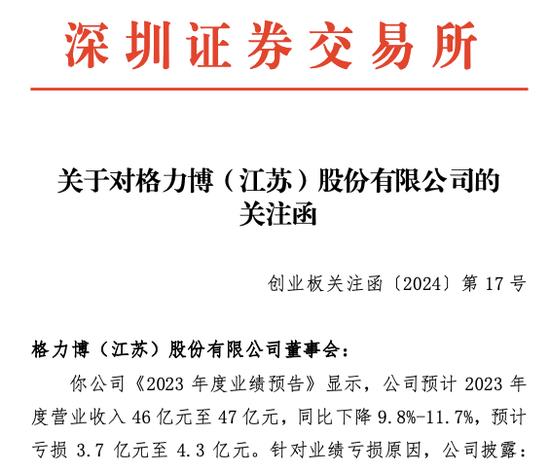

On January 31, 2024, Gree Bo released a performance forecast, saying that the company expects its operating income to be 4.6 billion yuan to 4.7 billion yuan in 2023, down 9.8% to 11.7% in the same period; It is estimated that the net profit returned to the mother will be a loss of 370 million yuan to 430 million yuan, a year-on-year decrease of 239.1% to 261.7%; It is estimated that the non-net profit will be a loss of 300 million yuan to 360 million yuan, down 235.7% to 262.9% year-on-year.

The year of listing was a huge loss, which immediately attracted the attention of Shenzhen Stock Exchange. On February 6, Shenzhen Stock Exchange sent a letter of concern to Gree Bo, asking Gree Bo to explain the specific impact of downstream retailers’ destocking on the company’s income; Rationality of the decline in gross profit margin; The reason and rationality of the increase in sales expenses.

Source: Screenshot of Gree Bo Announcement

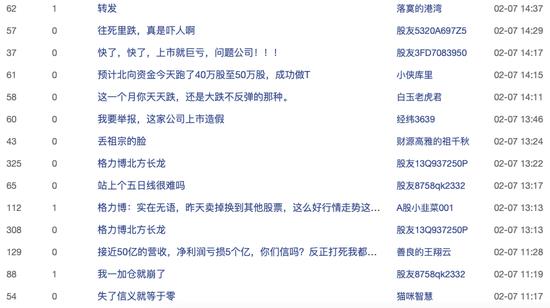

In this regard, many investors said that "listing will be a huge loss, a problem company!" "It’s been falling every day this month, but it’s still falling and not rebounding", "Doubtful life of falling", etc., and some investors questioned Gree Bo’s "fraud".

Source: screenshot of the stock bar

Moreover, according to the statistics of the media "Deepwater Finance and Economics", among the 1,072 listed companies that have issued advance notices, only 10 will be listed in 2023, of which 3 will reduce losses and 5 will increase losses. Among the 2 pre-losses, except those listed on the North Stock Exchange,(830809.BJ), Gree Bo is the only company that lost money in the first year of listing.

In 2019 and 2020, Gree Bo also has a net profit growth rate of over 200%; A year ago, with the aura of "the first share of new energy garden machinery", Gree Bo successfully went public with a gross profit margin and price-earnings ratio much higher than that of the same industry. What happened to Greebo in just one year?

Where is the loss?

In fact, Greebo’s losses have long been warned.

On February 8, 2023, Greebo successfully landed on the founding board. The first quarterly report after the listing of Greebo showed a decline in revenue and net profit. In the first quarter of 2023, Greebo’s operating income was 1.551 billion yuan, a slight decrease of 0.77%. The net profit of returning to the mother was 87 million yuan, down 40.78% year-on-year.

By the second quarter, Greebo directly turned into a loss. According to the semi-annual report of Gree Bo in 2023, in the first half of 2023, the company achieved an operating income of 2.581 billion yuan, down 18.79% year-on-year, and the net profit attributable to the mother was a loss of 54 million yuan, down 121.24% year-on-year.

In this regard, Gree Bo explained that the main reason is that retail wholesalers gradually turned to the active destocking stage, which slowed down the procurement pace of suppliers and the sales of the company’s products declined. Moreover, in order to go out of stock, Greebo stepped up product promotion in stages and lowered the prices of some old products through discounts and other means. In the first half of 2023, the gross profit margin of Gree new energy garden machinery products was 25.26%, down 1.17% year-on-year.

Even if the demand of downstream suppliers weakens, it is necessary to go to stock by promotion. But Greebo still believes that this is a good time to grab the market.

"In order to seize the favorable position in the market and strive for greater profits in the future, the company increased its sales investment. In the first half of the year, the company continued to increase its brand building, the sales staff increased, the marketing expenses increased, and due to the increase of the company’s scale and inventory goods, the storage expenses also increased significantly year-on-year."

According to the semi-annual report of 2023, the sales expenses of Gree Bo were 398 million yuan, up 40.93% year-on-year.

Although Greebo spent a lot of sales expenses, it still failed to stop the downward trend of performance. By the third quarter of 2023, Greebo’s losses were further aggravated, with revenue of 3.468 billion yuan, down 16.93% year-on-year; The net profit of returning to the mother was-175 million yuan, down 186.58% year-on-year.

The trend of "falling endlessly" still failed to stop in the fourth quarter. The operating income in 2023 is expected to be 4.6 billion yuan to 4.7 billion yuan, down 9.8% to 11.7% year-on-year; It is estimated that the net profit returned to the mother will be a loss of 370 million yuan to 430 million yuan, a year-on-year decrease of 239.1% to 261.7%.

According to Greebo’s disclosure, the reasons for the decline in performance are similar to those in the first three quarters. Including: due to the destocking of downstream retailers, the company’s operating income decreased by 9.8% ~ 11.7% year-on-year; The decline in operating income and gross profit margin affected the company’s gross profit by 190-210 million yuan; Sales expenses, research and development expenses and management expenses increased by 270-290 million yuan year-on-year; Due to the sharp year-on-year decrease in exchange income, the company’s financial expenses increased by about 130 million yuan in 2023.

Is the loss reasonable?

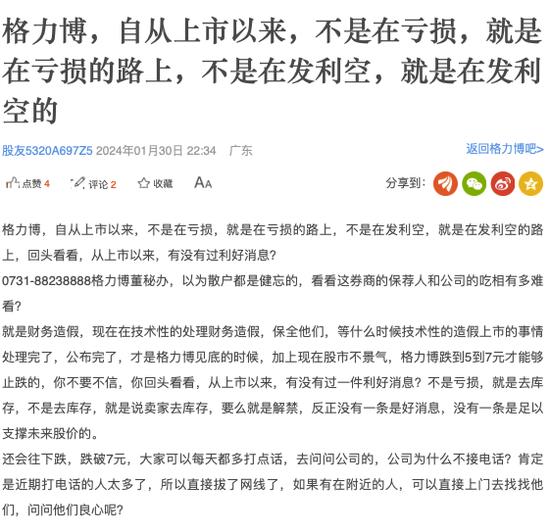

The huge difference before and after listing has made many investors question whether Greebo is "fraudulent".

Source: screenshot of the stock bar

First of all, the "destocking" mentioned by Gree Bo in the financial report is indeed the key word of the whole industry of lithium battery OPE in 2023.

"After two consecutive rounds of restocking, the channel inventory of retailers in Europe and the United States reached a historical high, and the demand side began to cool down under the influence of the Fed’s continuous interest rate hike. Therefore, since 2022Q3, retail began to enter the destocking cycle, and the order placing speed slowed down, which was reflected in the decline in the order growth rate of domestic agents and brands at the upstream production end." Ji Xiangyang, a researcher at China Merchants Household Appliances, said.

However, knowing that downstream suppliers have gone to their own inventory and there is no high consumer demand, Gree Bo still chooses to spend a lot of sales expenses.

According to the semi-annual report of 2023, among the sales expenses, all the detailed items of sales expenses of Gree Bo almost doubled. Among them, wages and salaries rose from 75.47 million yuan to 97.49 million yuan, advertising and marketing expenses rose from 109 million yuan to 128 million yuan, and storage expenses rose from 41.68 million yuan to 87.66 million yuan.

Source: screenshot of annual report

Although on the record sheet of investor relations activities on September 4, Greebo said that there were three major sales expenses in the first half of the year, namely, personnel salary, marketing and warehousing. With the decline of inventory level, warehousing expenses will decline in the second half of the year.

However, in the third quarterly report, Greebo’s sales expenses increased by 26.66% year-on-year, due to the increase of sales channels, storage fees and brand building and marketing.

Unsurprisingly, the money was spent and failed to bring corresponding returns. In 2023, Gree Bo’s revenue, net profit and gross profit margin declined across the board.

In this regard, Gree Bo still blames the downstream suppliers. "Due to the destocking of downstream retailers, the company’s related investment did not achieve the expected revenue growth. In 2023, the company’s own brand business revenue was basically the same as that in 2022."

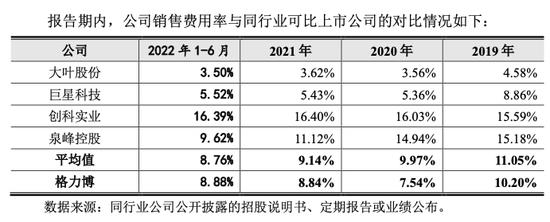

It is worth noting that before listing, Gree Bo’s sales expense ratio was lower than that of its peers, and its gross profit margin was higher than that of its peers, which shows that Gree Bo can obtain higher sales revenue and profits at a lower cost. However, after listing, this advantage of Greebo suddenly disappeared, which increased the sales expenses, but the gross profit margin fell to the average level of peers. From 2019 to 2022, and from January to June in 2023, the comprehensive gross profit margin of Gree Bo was 34.49%, 35.10%, 27.5%, 25.72% and 25.26% respectively.

Source: Screenshot of Prospectus

"If a company’s gross profit margin is high, it means that the competitiveness of its products is stronger than that of other companies in the same industry, and the company should have certain negotiating advantages in product sales. It can be inferred that the company’s sales expenses will not account for a high proportion of operating income. If the gross profit margin of the company is much higher than that of the same industry, and its sales expense ratio is also lower than that of the same industry, it is unreasonable; Similarly, if the company’s gross profit margin is much lower than that of the same industry and its sales expense ratio is higher than that of the same industry, it is equally unreasonable. " Ma Jinghao, an expert in finance and taxation, said.

On March 22nd, 2023, just one month after the listing of Gree Bo, Kelvin Cui, then the company’s chief financial officer, and Ji Zhenghua, the secretary of the board of directors, left their posts. Among them, Kelvin Cui has served as the chief financial officer, director and chief financial officer of Gree Bo since November 2018; Since December 2018, Ji Zhenghua has served as assistant to the chairman of Gree Bo and secretary of the board of directors of Gree Bo.

As of February 8, 2024, Gree Bo’s share price closed at 11.35 yuan/share, which was 63.21% lower than the issue price (30.85 yuan/share). The total market value has shrunk to 5.553 billion yuan.

Source: screenshot

The stock price fell to "knee"

Can the Master of Returnees "pull back a city" by increasing their holdings?

According to the Prospectus, Gree Bo was established in 2002, and has been engaged in research and development, design, production and sales of new energy garden machinery since 2007. It is one of the leading enterprises in the global new energy garden machinery industry.

The company mainly sells its own brands, and its products can be divided into lawn mowers, lawn mowers, cleaning machines, hair dryers, pruning machines, chain saws and intelligent mowing according to their uses., intelligent mounted mowing vehicle, etc. At present, there are brands such as greenworks and POWERWORKS under the company flag (Jin Qilin analyst).

The actual controller of the company is Chen Yin, the co-founder and chairman, who was born in 1973 and is 51 years old.

Chen Yin has rich working experience in foreign-funded enterprises. He studied in England and got a master’s degree. After that, he successively served as the product manager of Shanghai Biocy Gas Co., Ltd., a foreign-funded enterprise, and the general manager of Shanghai Star Jack Power Tools Department, a foreign-funded enterprise. Later, he also served as the general manager of the Asia-Pacific procurement center of Fiskars Group in Finland.

In 2016, Chen Yin, who has a foreign working background, also introduced an external investor from Germany-STIHL to Greebo. STIHL is a manufacturer of garden machinery and a customer of Greebo.

In 2020, Greebo was changed into a joint-stock company, and on May 21, 2021, it submitted the Prospectus on the Growth Enterprise Market of Shenzhen Stock Exchange. After nearly three years, Greebo went public on February 8, 2023. At that time, it was called "the first share of new energy garden machinery" by the outside world.

After listing, the performance of Greebo’s share price rose all the way. Its listing price was 30.85 yuan/share, the highest price reached 41.82 yuan/share on the first day of listing, and finally closed at 38.3 yuan/share, with a total market value of 18.62 billion yuan.

According to the third quarterly report in 2023, Chen Yin holds about 56.32% of the shares in Gree Bo. Based on this calculation, Chen Yin is worth 10.487 billion yuan.

Who knows, Greebo’s share price peaked when it went public. Only one month later, it "showed its original shape" and then it "sat on the slide" all the way. On March 14th, 2023, Gree Bo’s share price fell below the issue price, and the lowest price on that day was 29.17 yuan/share.

Chen Yin’s worth has also shrunk. According to the Hurun Report, Chen Yin made his debut in the 2023 Hurun Report with a net worth of 5.5 billion yuan.

Source: screenshot of Hurun Report

Galaxy Securities said that the deduction of new shares breaking tide is directly related to the price-earnings ratio of initial public offering. According to the Prospectus, the initial price-earnings ratio of Gree Bo is over 63 times, which is significantly higher than the industry’s price-earnings ratio of 33 times. According to wind data, as of February 7, 2024, the static P/E ratio of Gree Bo was 18.09 times.

Source: screenshot of straight flush

Faced with this situation, on February 6, 2024, Gree Bo released an increase plan. According to the announcement, GHHK, the controlling shareholder of the company, or Chen Yin, the chairman of the company, intends to increase the company’s shares within six months. The planned amount of this increase is between 25 million yuan and 50 million yuan.

However, can Chen Yin, a master of returnees, "stop" the falling stock price by increasing his holdings?

What do you think of Greebo’s "performance change" in its first year of listing?