Intel’s ninth-generation Core has now begun to spread out gradually, and it has launched a comprehensive fight with AMD’s Ruilong.

The performance is quite powerful, but the corresponding power consumption and price are also amazing, soRelatively speaking, many students will pay more attention to the i7-9700K. After all, it is more balanced in terms of specifications, performance and price.

Today, I will bring the test report of the first i7 processor without hyper-threading technology.

Description of product specifications: The appearance of i7-9700K is exactly the same as that of i9-9900K, so I won’t repeat it here. Here is a brief look at the product specifications.

Compared with i9-9900K, the obvious difference is that the core scale has changed from 8 cores and 16 threads to 8 cores and 8 threads, and the hyper-threading technology has been cancelled. In fact, except i9-9900K, all the nine generations of Core have no hyper-threading.

The core frequency drops slightly,The dual-core turbo frequency is 4.9GHz and the full-core turbo frequency is 4.6GHz.

Introduction of test platform:

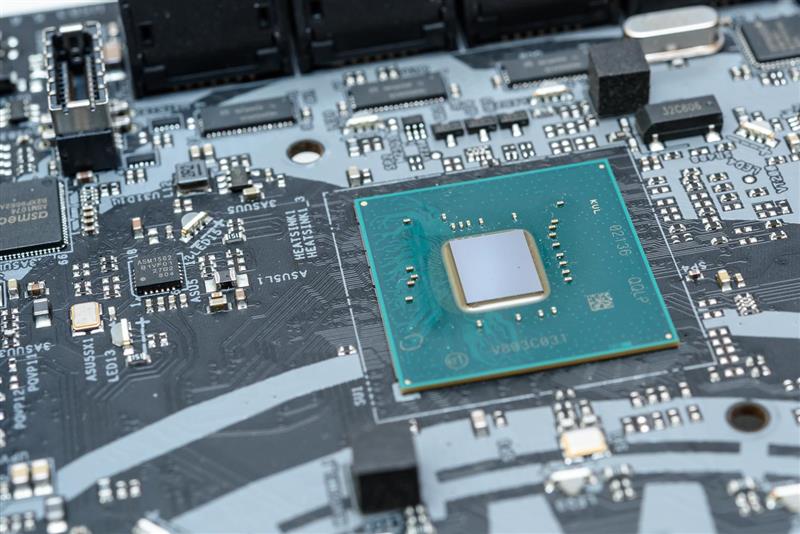

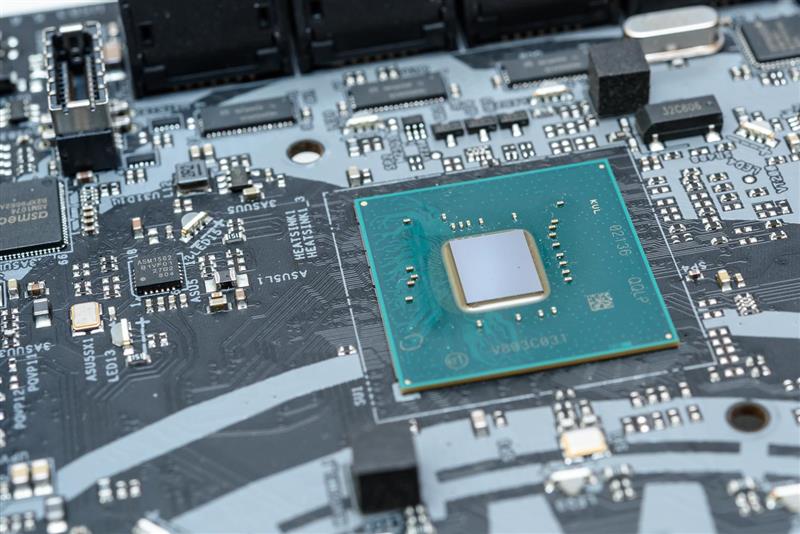

This time, the motherboard is Huaqing Z390-TAICHI, which is also a product with high attention at present. After careful disassembly, it is found that this product is quite different from Gigabyte Asustek’s design idea, which is very interesting.

The CPU base is still LGA1151, Intel’s ancestral base, which will be used in 2020.

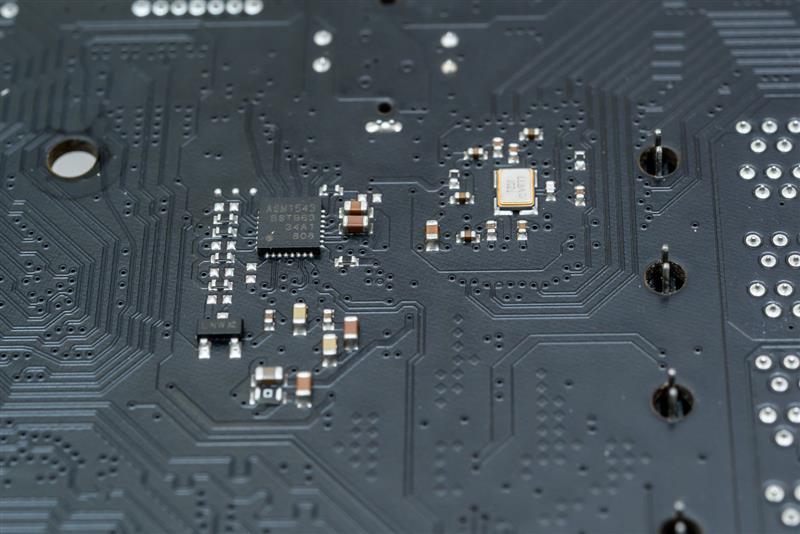

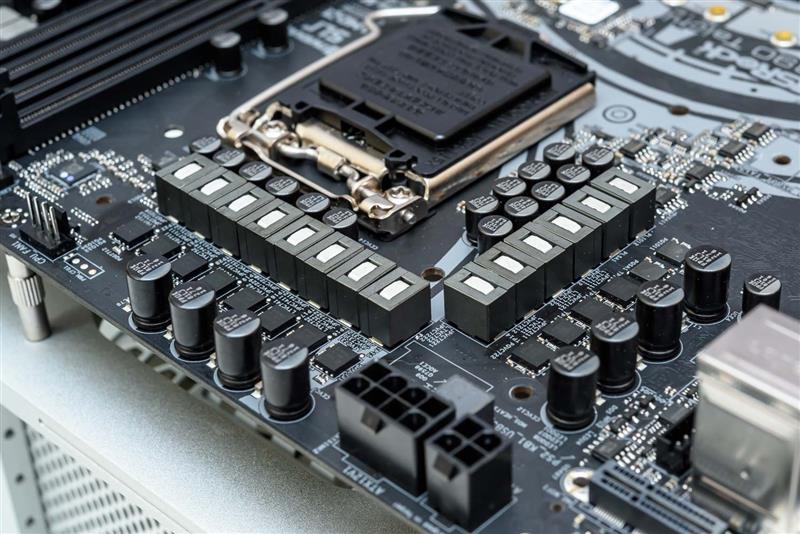

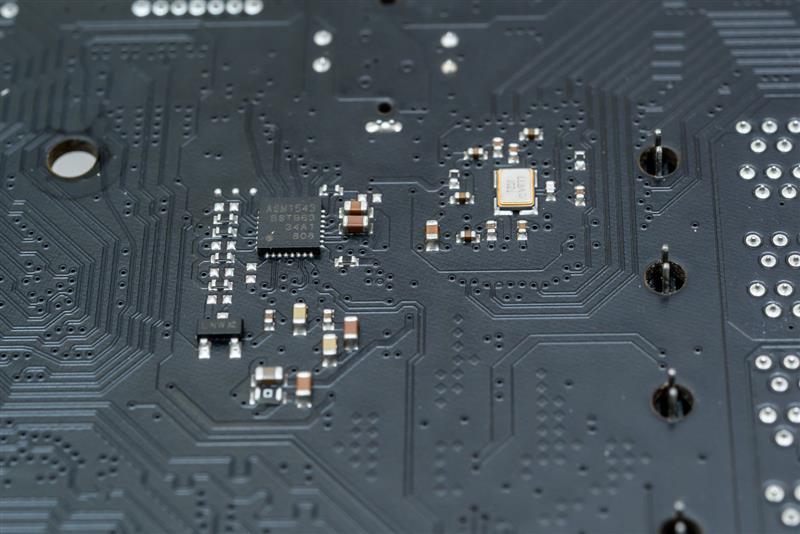

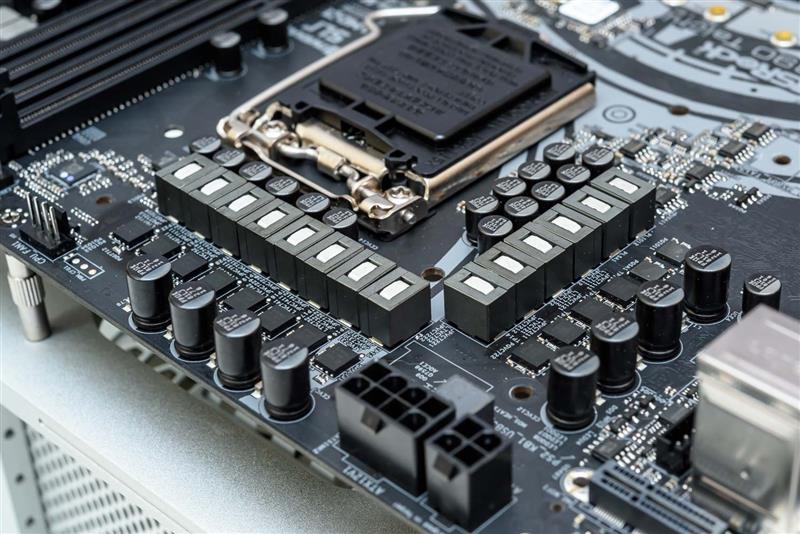

A set of filter capacitors can be seen on the back of the CPU base, and Huaqing also added two additional polymer capacitors to improve the stability of the motherboard current.

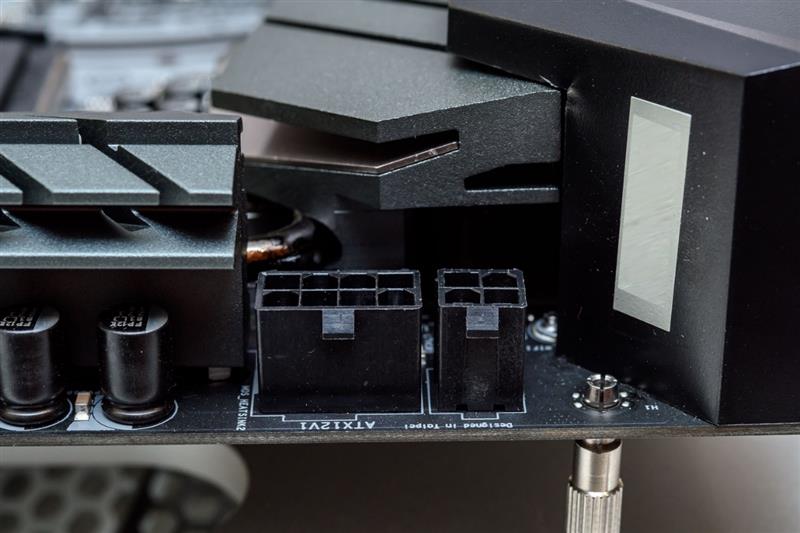

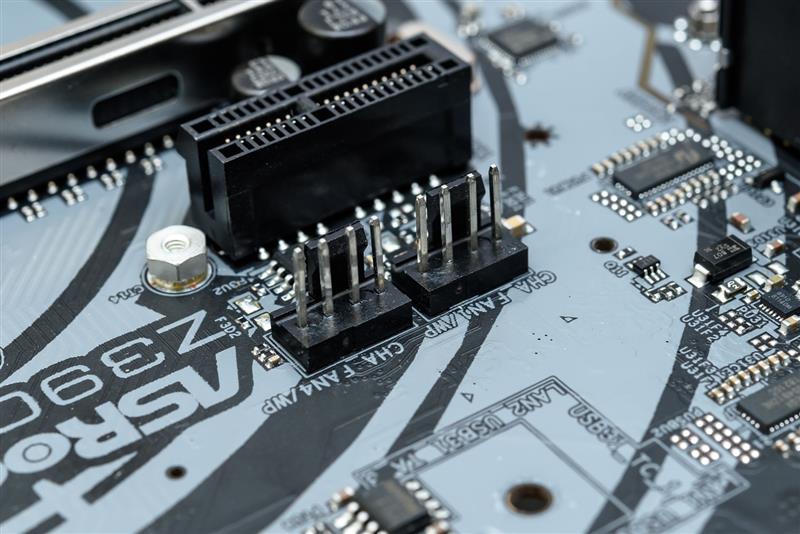

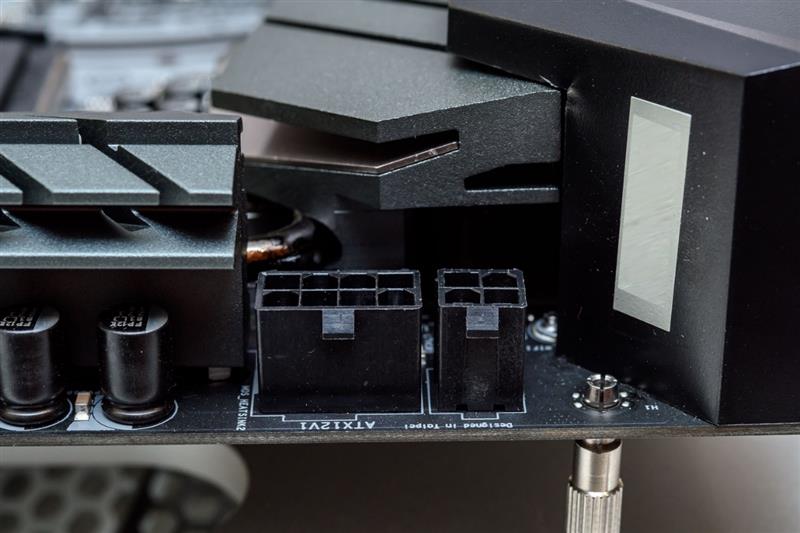

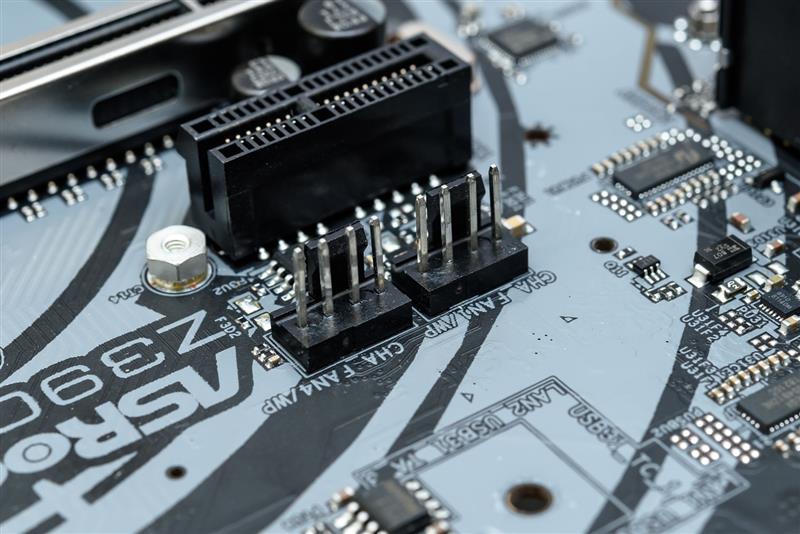

The power supply socket of CPU is 8+4PIN, mainly to cope with i9-9900K.

The power supply of CPU is 10+2+2 phases, and heat pipe fins are used to assist heat dissipation, that is to say, the CPU core supplies 10 phases, the centralized display supplies 2 phases and the bus supplies 2 phases.

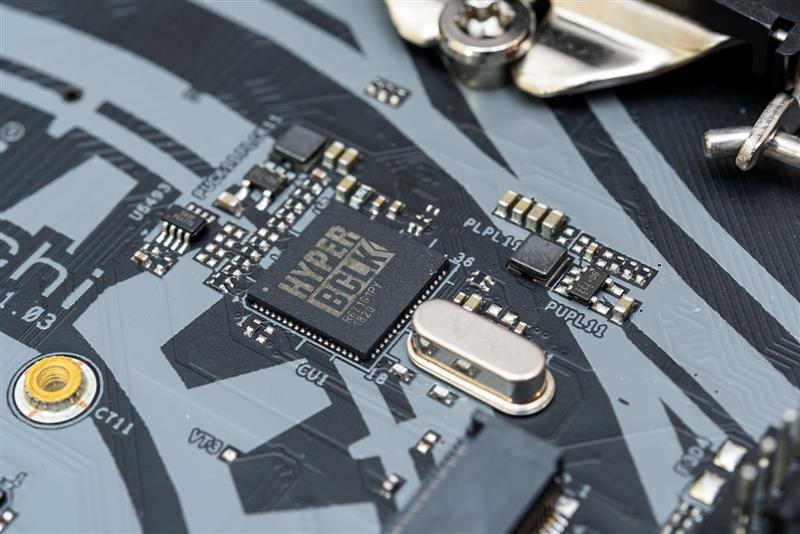

There is also a R67161PY chip next to the CPU base, which is used to unlock the CPU external frequency adjustment limit from the wiring point of view.

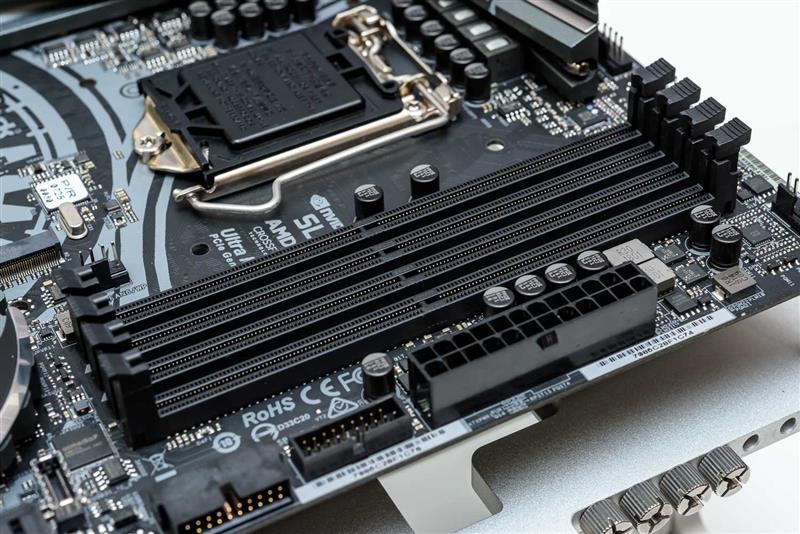

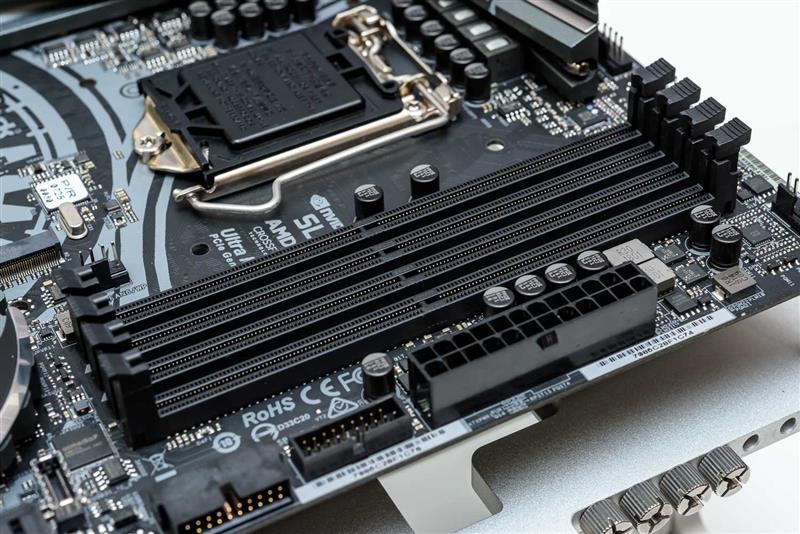

There are still four memory slots, which support dual-channel DDR4.

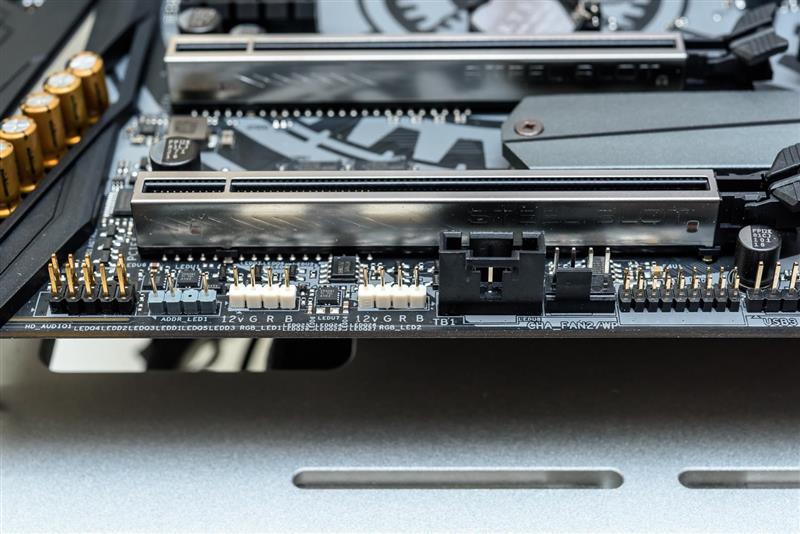

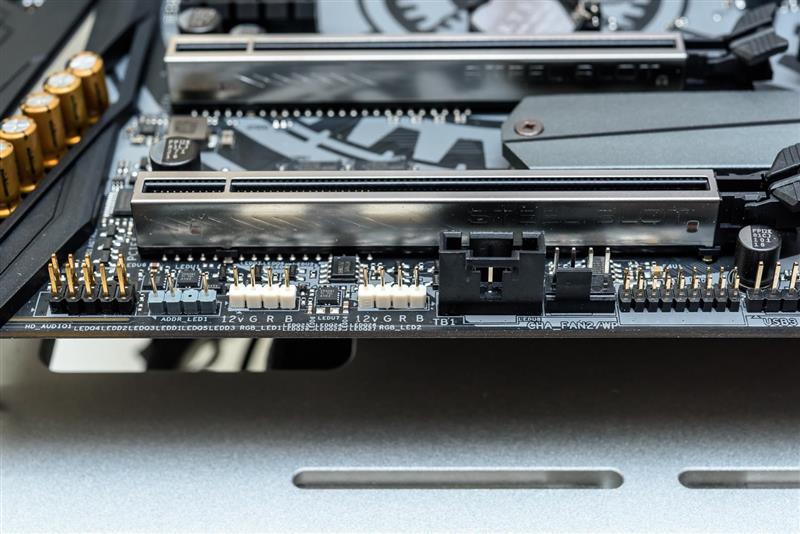

There are five expansion slots on the motherboard, which are arranged as X1X16NAX1X8NAX4 according to the PCI location, among which the slots of PCI-EX1 are all designed with notches, which can be compatible with high-bandwidth PCI-E expansion cards, such as SATA cards of PCI-E X4.

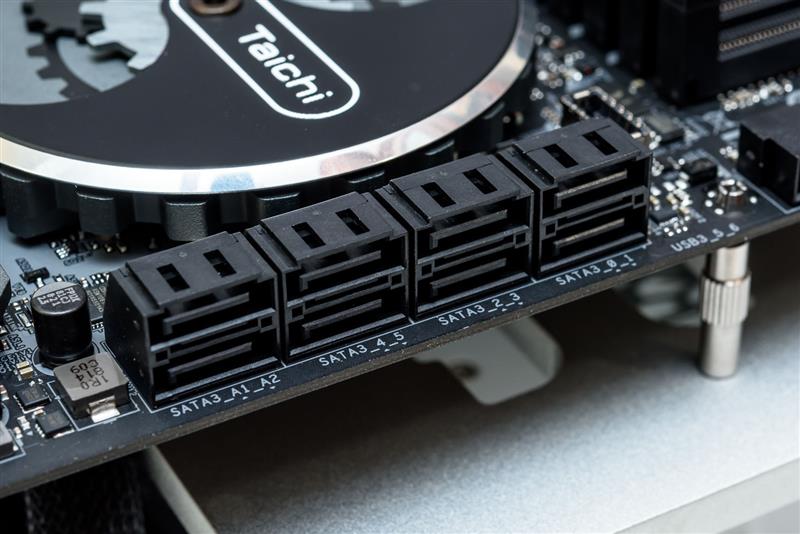

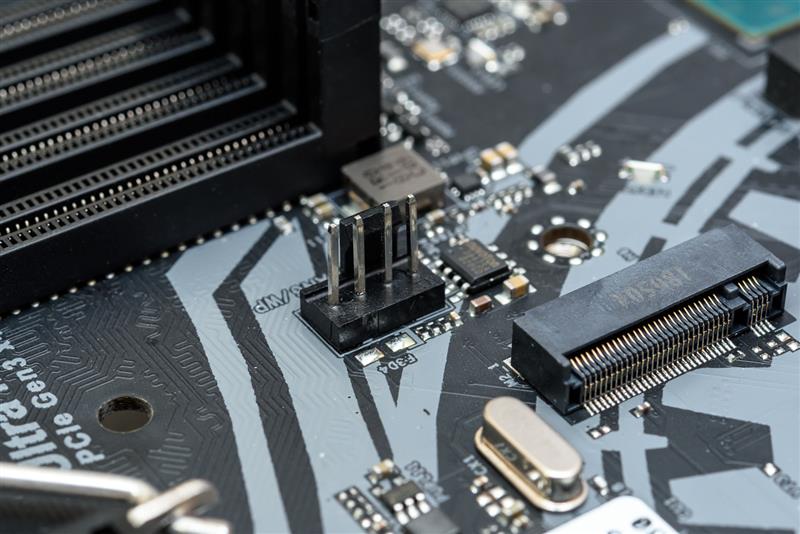

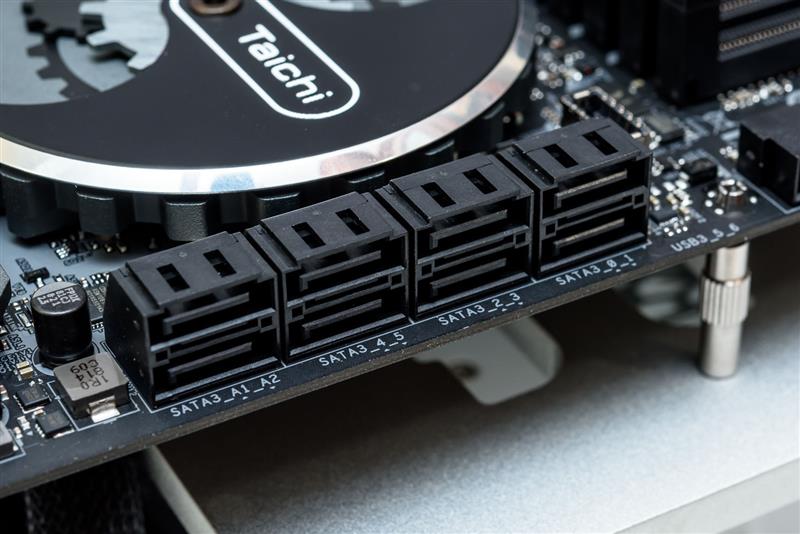

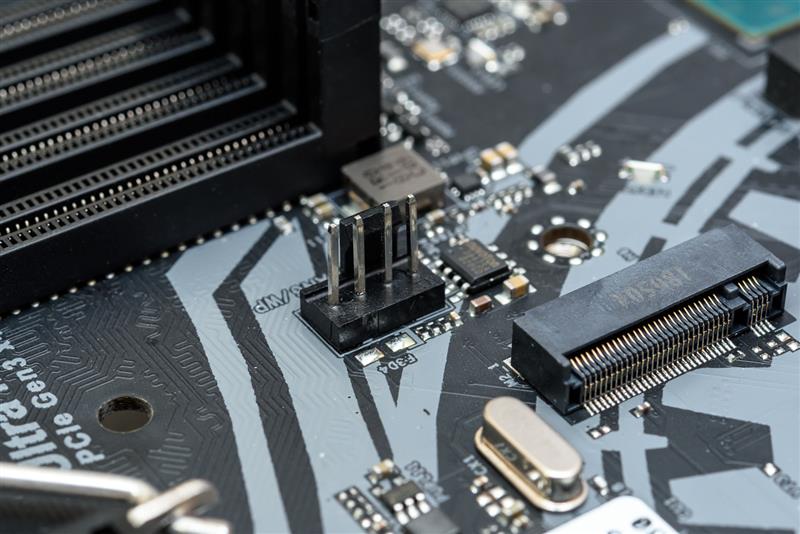

There are three M.2 SSD expansion slots on the motherboard, all of which can support PCI-E X4 and SATA channels. However, the slots on the left (M2_1) and the right (M2_3) in the figure occupy two SATA interfaces, which are mutually exclusive. The slot in the middle (M2_2) will eat a SATA interface when using the SSD of SATA channel. The M2_3 slot of the motherboard is covered with a metal heat sink.

There is a 24PIN power supply interface and two USB 3.0 front sockets on the side of the motherboard near the memory slot, one of which is horizontal.

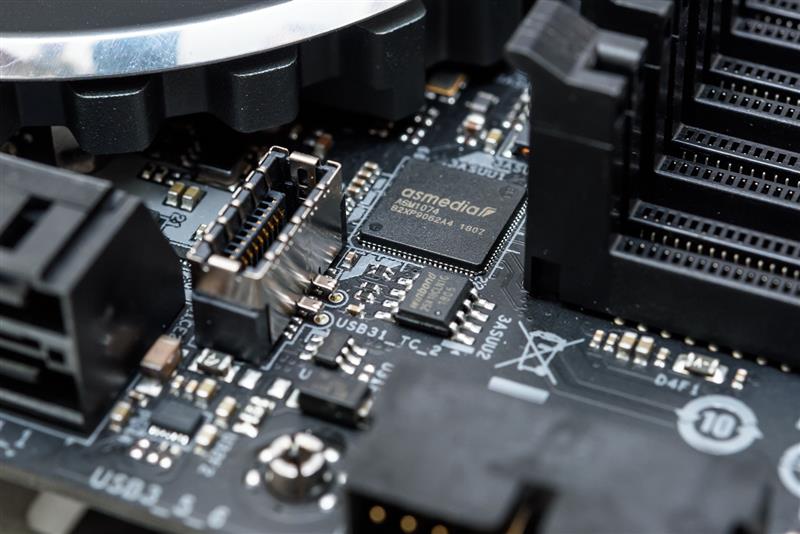

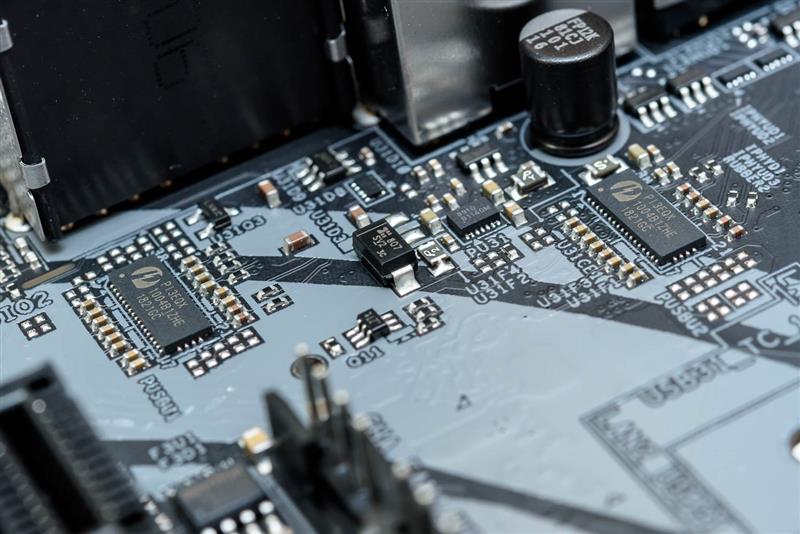

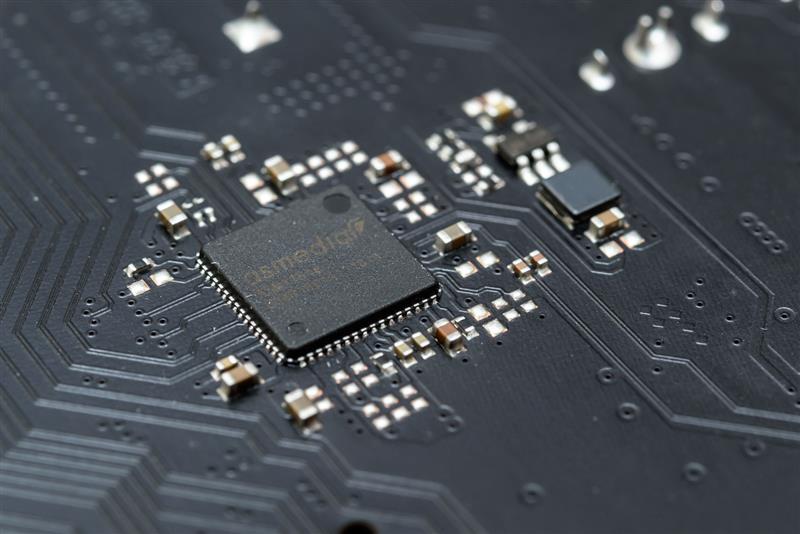

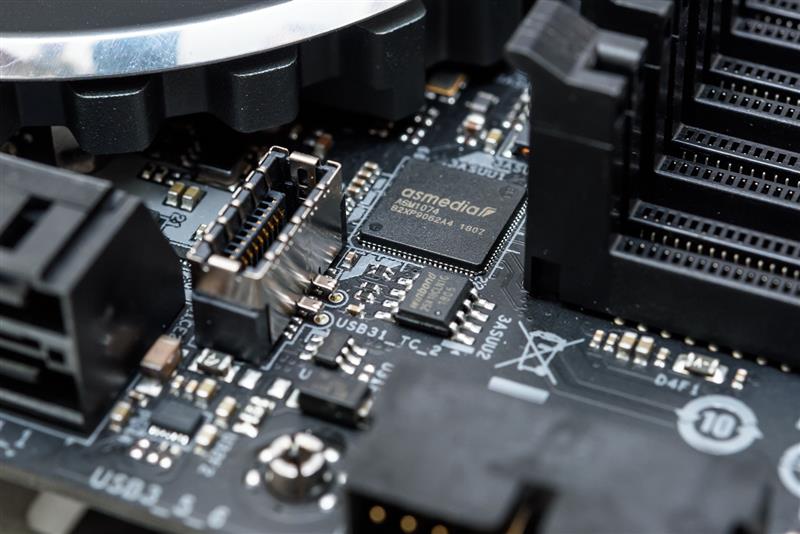

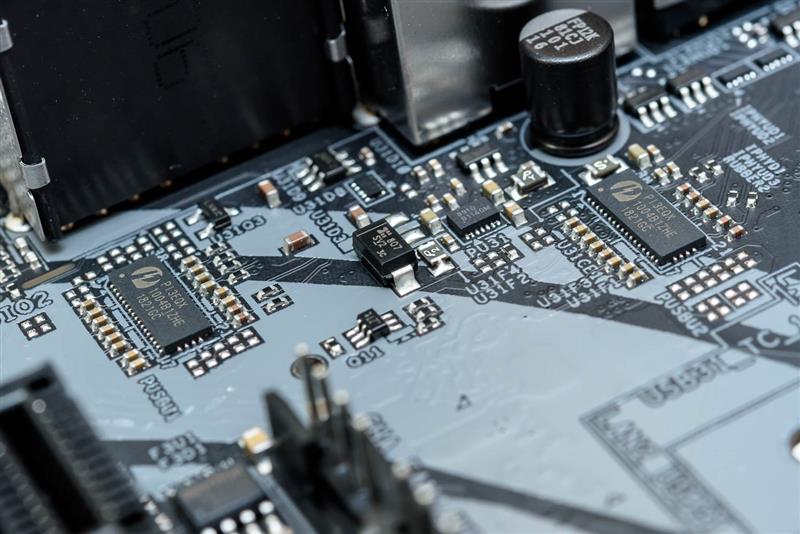

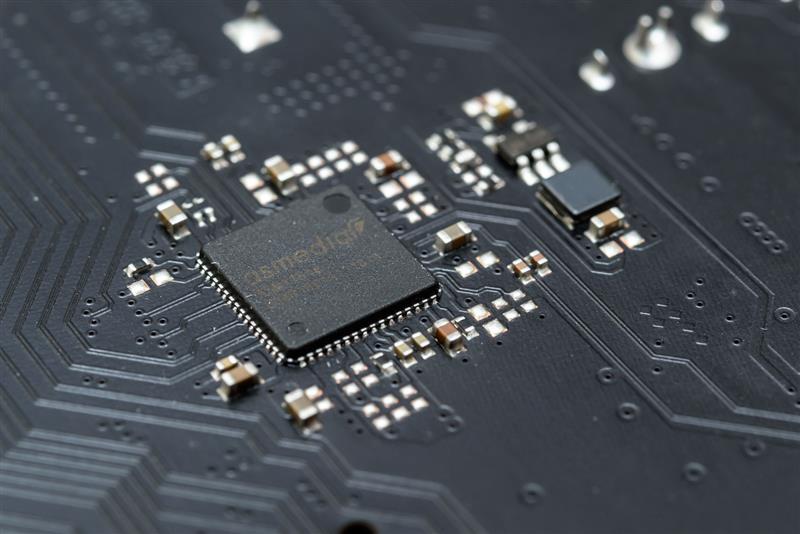

The front USB 3.1 Type-C socket can be seen between the memory slot and the SATA interface. The ASM1074 chip next to it is the channel for two USB 3.0 sockets on the motherboard.

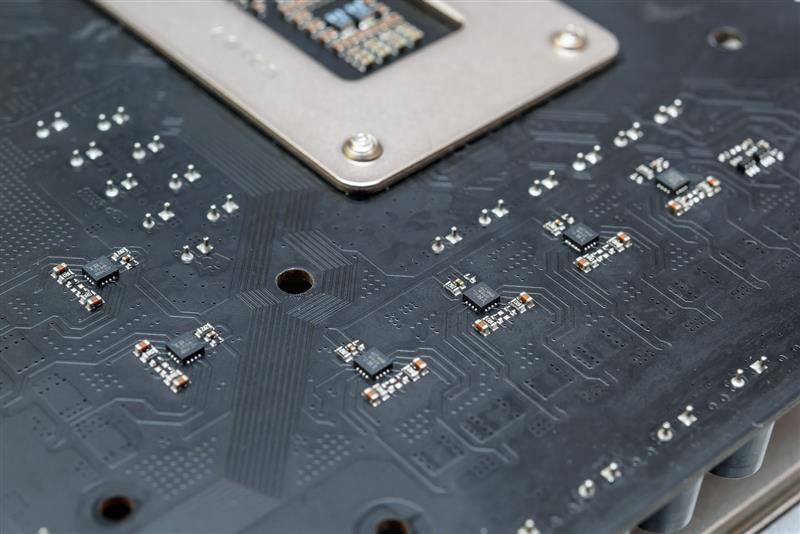

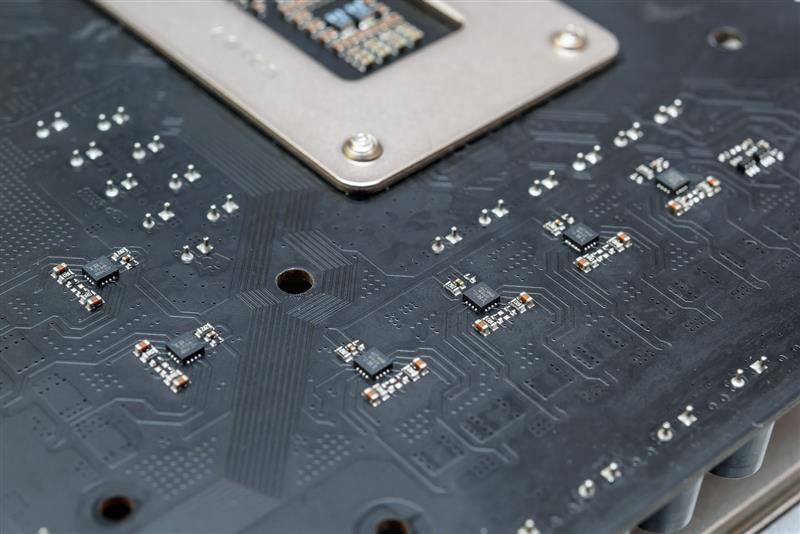

The chip of USB Type-C is on the back of the motherboard, and it is an ASM1543. It seems that the mode of chipset direct connection USB 3.1 Type-C used by Huaqing in the past is not very effective, and this time an extra bridge chip is added.

There are 8 SATA interfaces on the motherboard, of which 6 are provided by the chipset natively, 2 are extra bridges, and the bridge chip is ASM1061.

At the bottom of the motherboard is a row of expansion slots. From the chipset side, from right to left, they are SYS FAN, chassis front control pin, BIOS test pin, BIOS cleaning pin, 80 debug lamp, front USB 2.0 and front USB 2.0 (single interface 4PIN). The single-port USB 2.0 pin is a bit strange. This interface is because a USB 2.0 was eaten by wireless Bluetooth, so the general motherboard will not let go directly, because the wires of the chassis are now in groups of two. It’s ok to control the cold headlight group inside the chassis.

Close to the audio system, from right to left in the figure are TPM, SYS FAN, lightning extension pin, RGB 4PIN lamp strip pin *2, digital LED strip pin and front audio pin.

In addition to the two SYS FAN pins at the bottom of the motherboard, the motherboard has three pins between CPU power supply and memory slot, two pins next to PCI-E X1, and one pin between memory slot and M.2 SSD slot. The number of fan pins is still sufficient.

The rear window interfaces of the motherboard are, from the left in the figure, clear COMS button, Wi-Fi antenna interface, USB 3.0*2+PS2, HDMI+DP, USB 3.0*2, USB 3.1*2+LAN, USB 3.1 A+C +LAN, and 3.5 audio *5+ digital fiber.

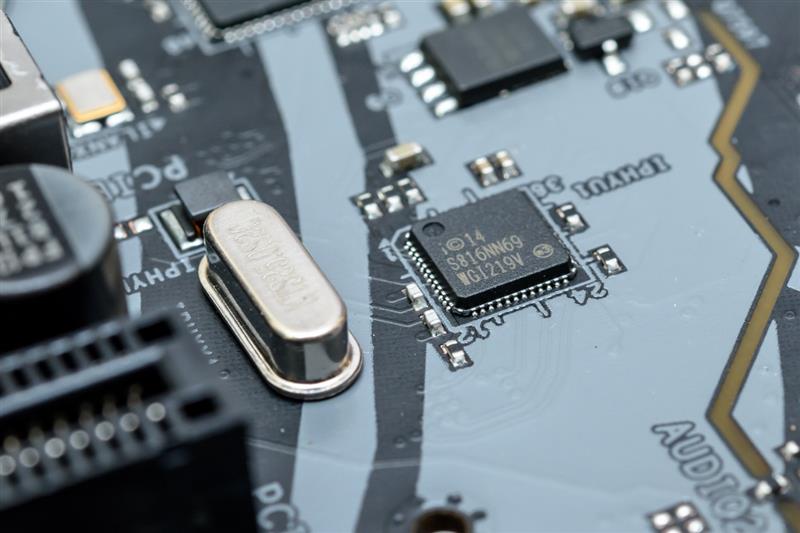

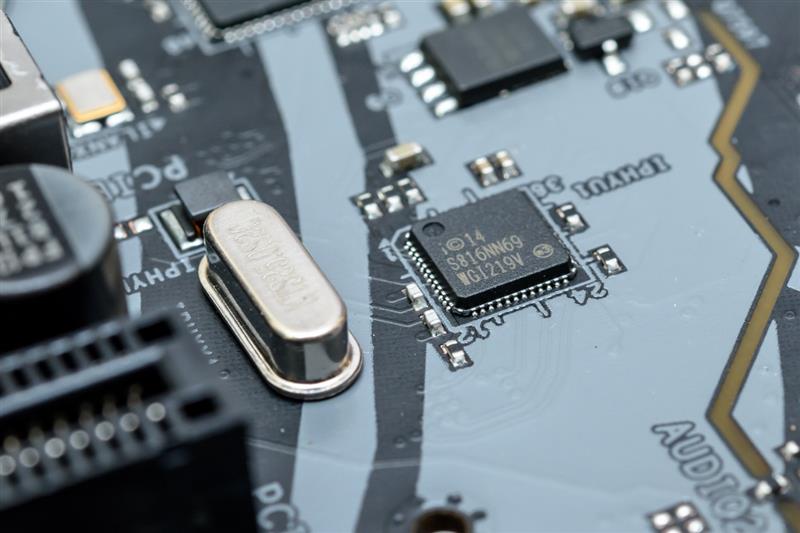

The main chip of the audio part is ALC1220 of Little Crab, and the power amplification effect of the audio interface in the rear window of the main board is provided by ALC1220 chip. The front audio provides power amplification effect through N5532 chip.

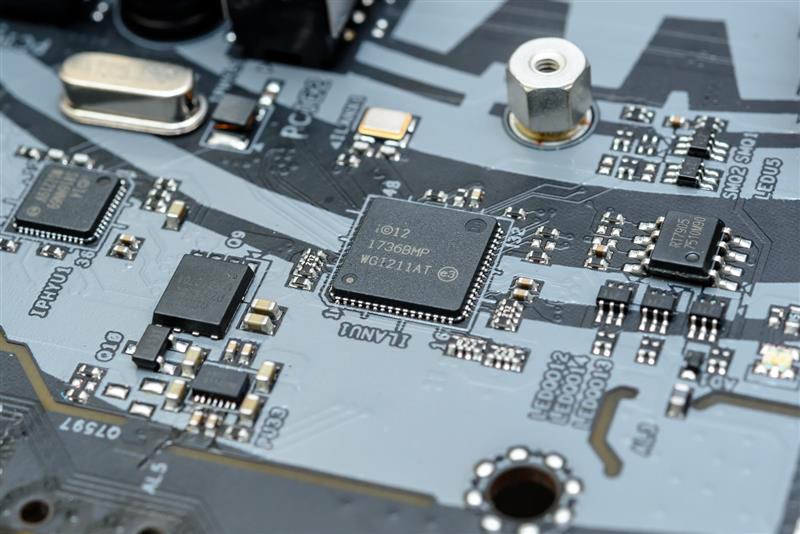

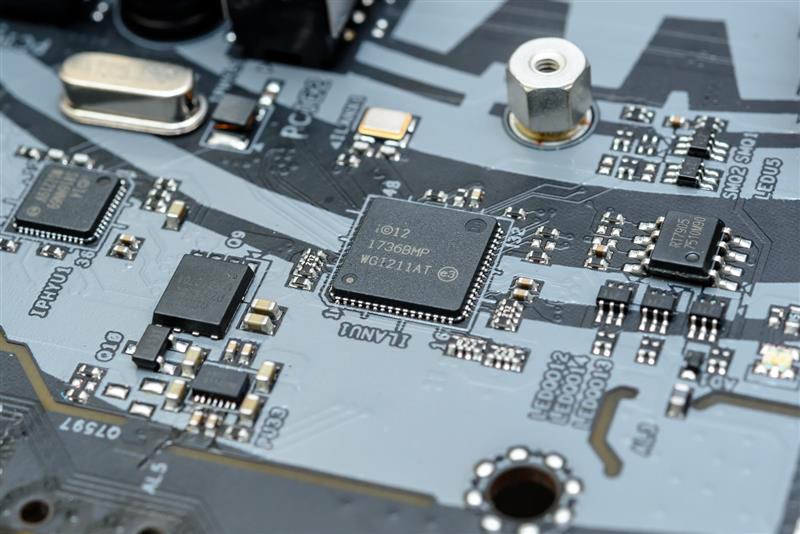

The motherboard adopts dual Gigabit network cards and the mainstream Intel i211+i219 scheme.

The motherboard is integrated with a wireless network card, and the model is Intel’s 3168N.

You can see an ASM1562 chip next to the motherboard chipset, which is two USB 3.1 TYPE-A interfaces corresponding to the motherboard rear window. The three bridge chips behind the SATA interface at the top of the picture are used to switch with the M.2 SSD slot.

The two P13EQX chips in the rear window of the motherboard are used for signal relay of ASM1562 chip and two USB 3.1 TYPE-A interfaces in the rear window of the motherboard.

The ASM1543 on the back of the motherboard provides a bridge for USB 3.1 A+C on the rear window of the motherboard.

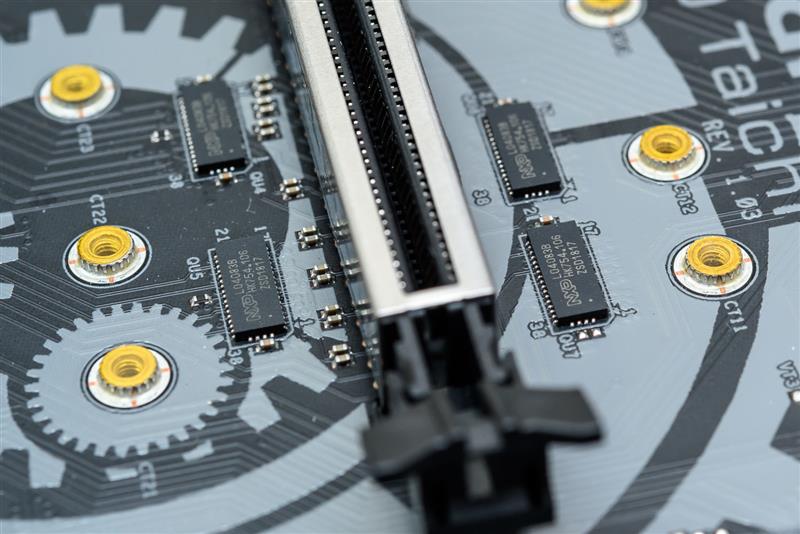

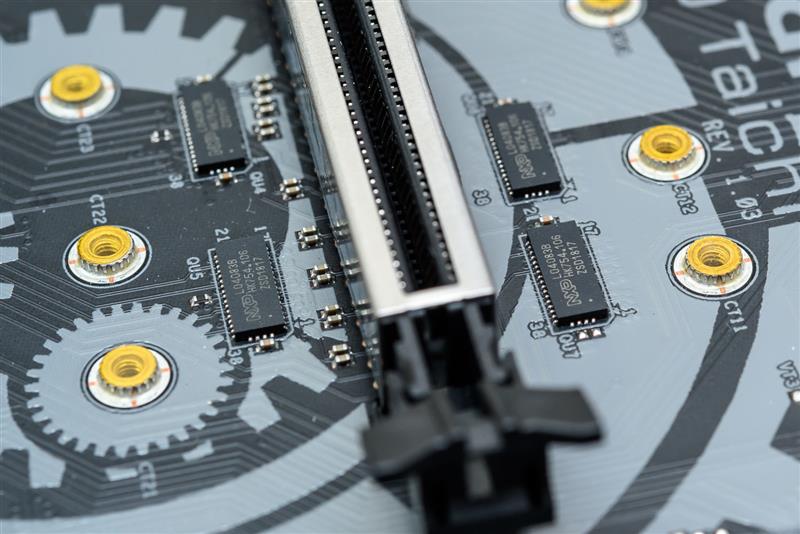

There are two L04083B chips at the end of PCI-E X16 slot on the motherboard, which are used to bridge the bandwidth of the graphics card slot to support the 8+8 dual card mode of the graphics card.

Next, the motherboard was disassembled, and the number of armor of Huaqing motherboard was not particularly exaggerated.

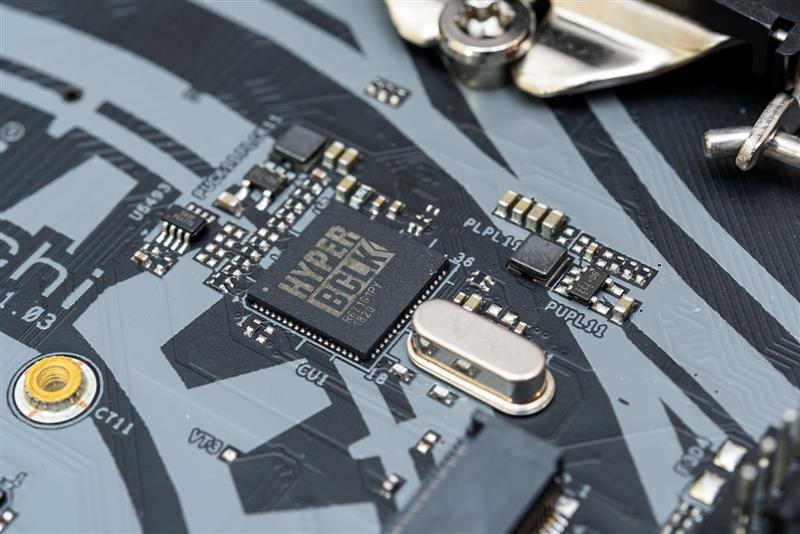

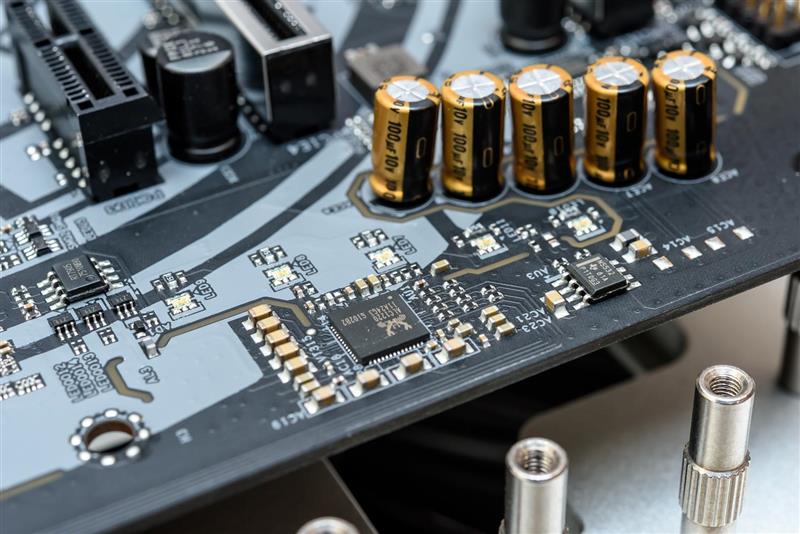

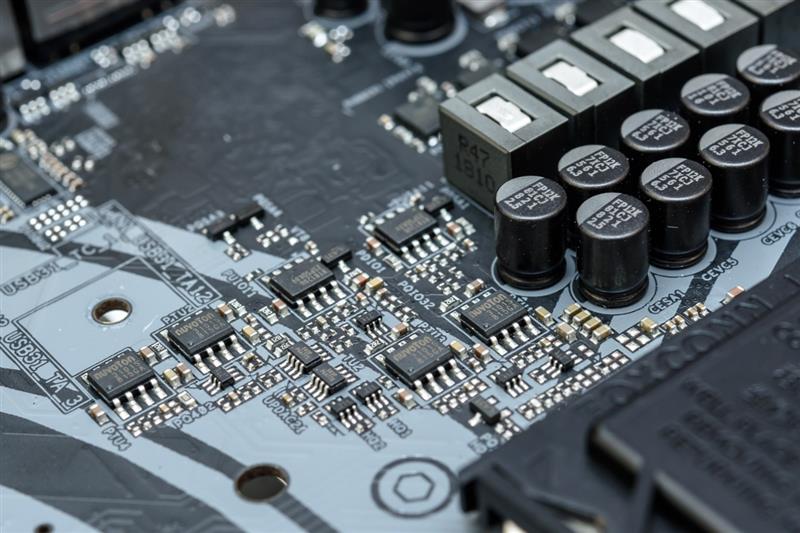

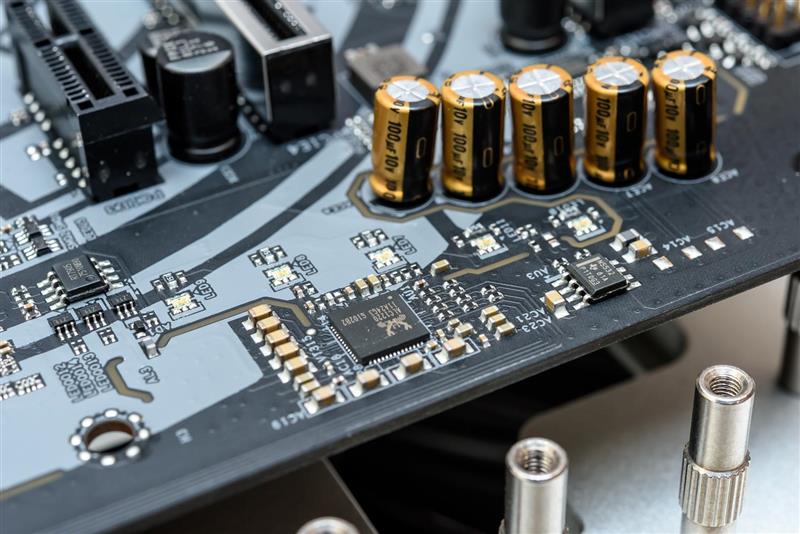

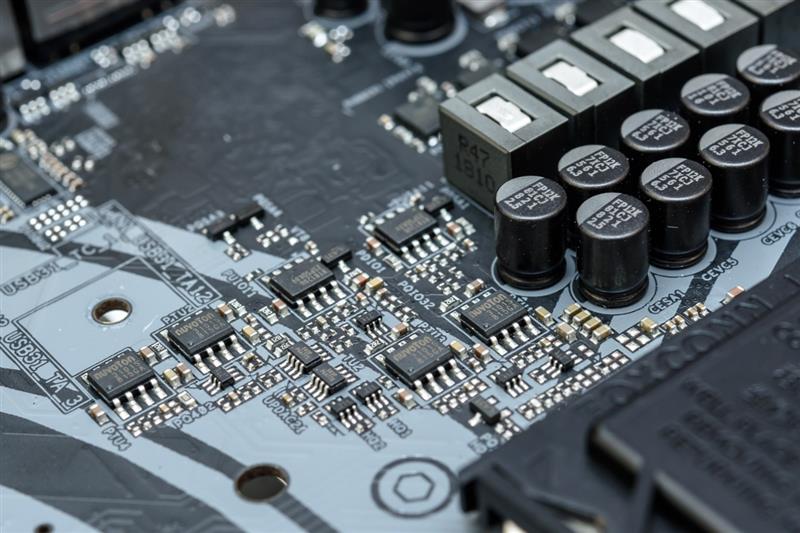

The power supply of the motherboard is 10+2+2 phases, the CPU core part is 10 phases, and the centralized display part is 2 phases, both of which share the same scheme. The PWM chip is IR 3520, which is a 6+2-phase control chip, and the DRIVER is extended to 10+2-phase power supply through IR 3598; The input capacitance is 8 solid-state capacitors of Nijikang FP12K, 16V 172 microfarads; MOS adopts one TI 87350D drMOS for each phase, and one MOS can achieve the function of bridge. The inductance is a closed inductor with one inductance R47 per phase; The output capacitors are 10 in the CPU core part and 3 in the display part. The capacitors are all Nijikang FP12K solid-state capacitors with 6.3V 561 microfarads.

The other two items on the motherboard are for the power supply of VCCSA and VCCIO, and the materials used in this part have been reduced. The input capacitance is shared by one Nijikang FP12K solid-state capacitor, with 16V 101 microfarads; MOS is 1 7341EH; per phase; The output capacitor is 1 Nijikang FP12K solid capacitor per phase, 2.5V 821 microfarads.

Memory power supply is a luxury, using 2-phase power supply directly. The PWM chip is UP1674P;; The input capacitance is 2 solid-state capacitors of Nijikang FP12K, 6.3V 561 microfarads; MOS is 87350D drMOS with one TI per phase, which is the same as CPU power supply; The inductance is a closed inductor with one inductance R30 per phase; The output capacitor is 4 solid-state capacitors of Nijikang FP12K, 6.3V 561 microfarads.

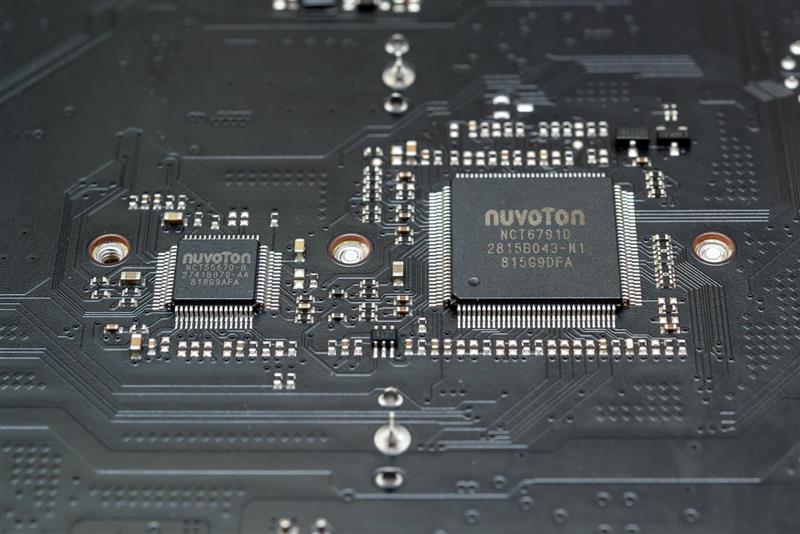

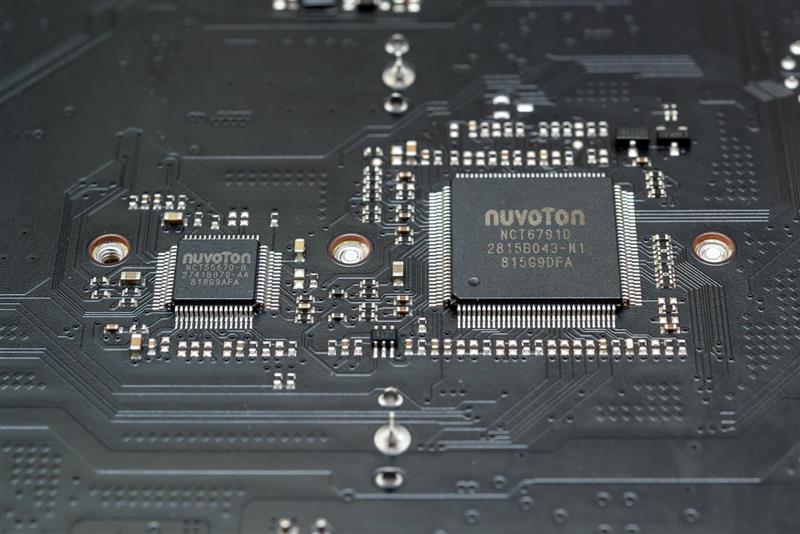

There is also a hardware monitoring chip of nuvoTon NCT6791D and a super IO chip of Nuvoton NCT 5567d on the motherboard. The integration level is still a little low.

There is also an ASM1184 chip on the motherboard, which is used to switch PCI-E channels and bridge one PCI-E 3.0 into four PCI-E2.0. Generally speaking, the design ideas of Huaqing and Gigabyte Asustek are quite different. Asustek Gigabyte prefers to use a lot of SWITCH switching and speed reduction to solve the problem of insufficient chipset channels. Huaqing, on the other hand, prefers to use more HUB chips for switching, so as to minimize the loss of PCI-E bandwidth. However, the cost is also obvious. More chips reduce the integration of the motherboard.

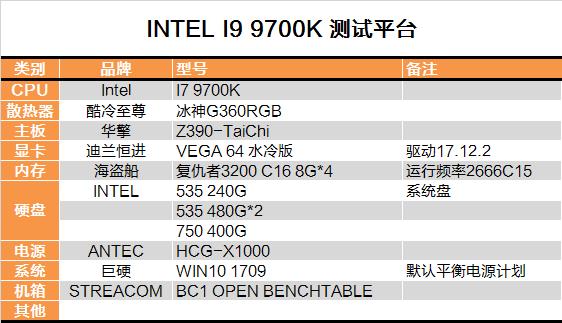

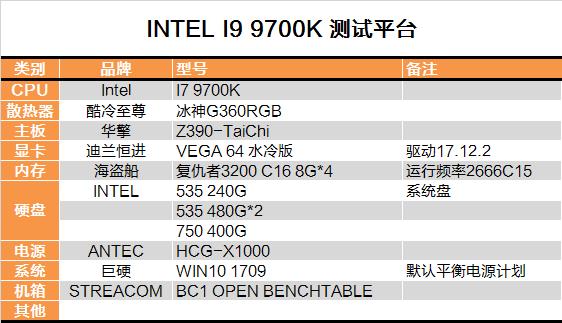

Introduction of test platform:

First, introduce the test platform.

The memory is DDR4 8G*4 of the pirate ship. The actual operating frequency is 2666C15.

There will be a test with a unique display in the middle, and the graphics card is the water-cooled version of VEGA 64 by Dylan Hengjin.

SSD is three pieces of Intel, and the system disk uses the mainstream 535 to ensure that the test is closer to the average user. 240G is used as the system disk, and 480G*2 is mainly used to play test games.

The NVMe SSD test used Intel 750 400G.

The radiator is the cool ice god G360RGB.

The power supply is an Antaike HCG-X1000.

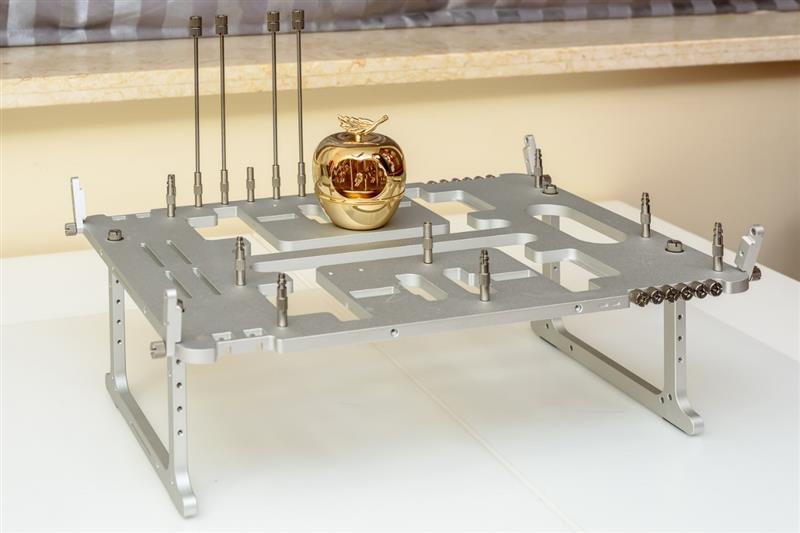

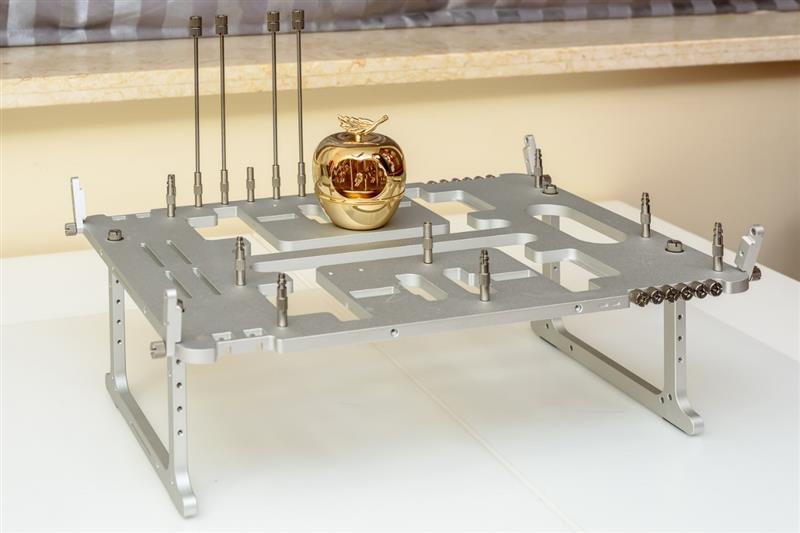

The test platform is BC1 of Streacom.

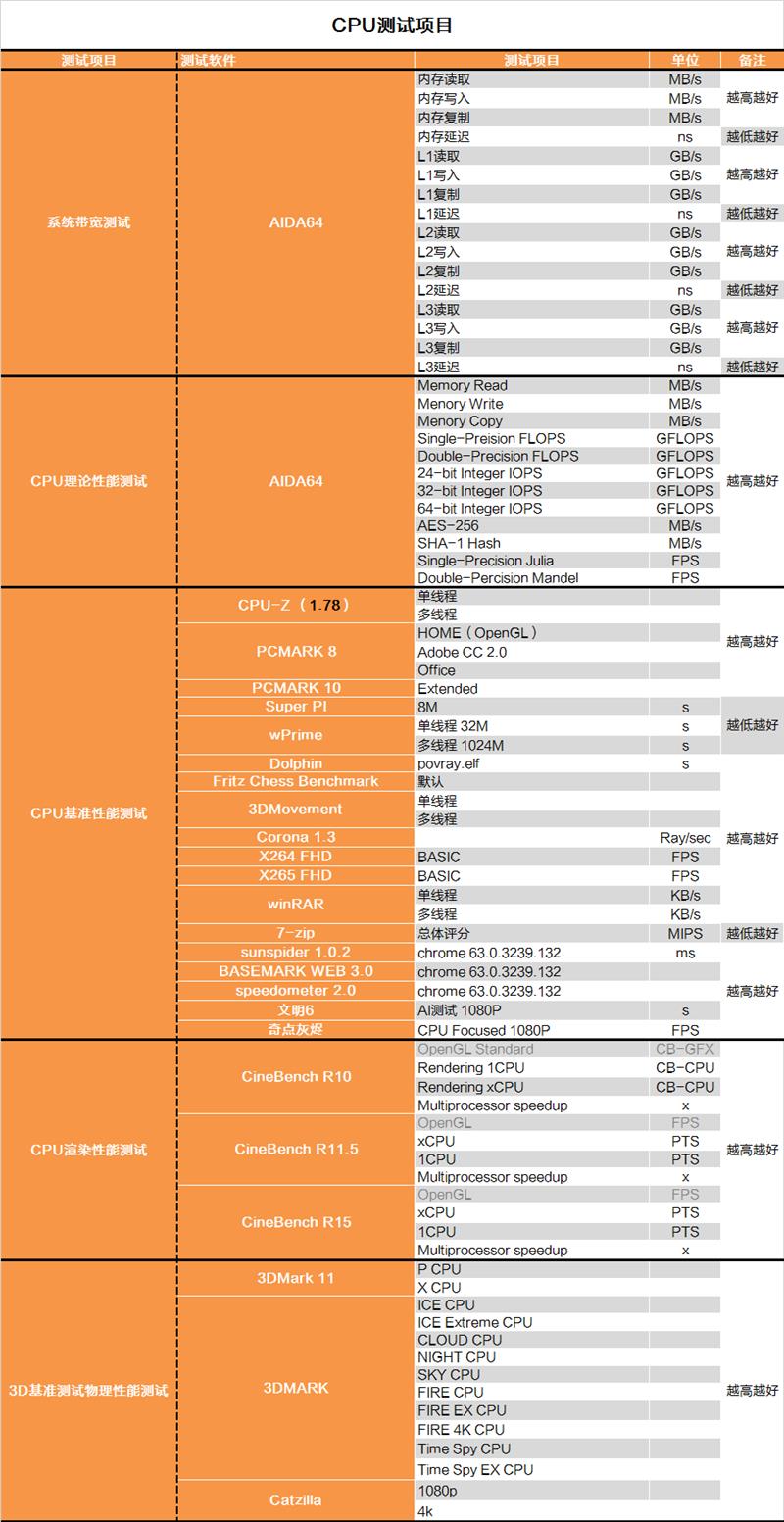

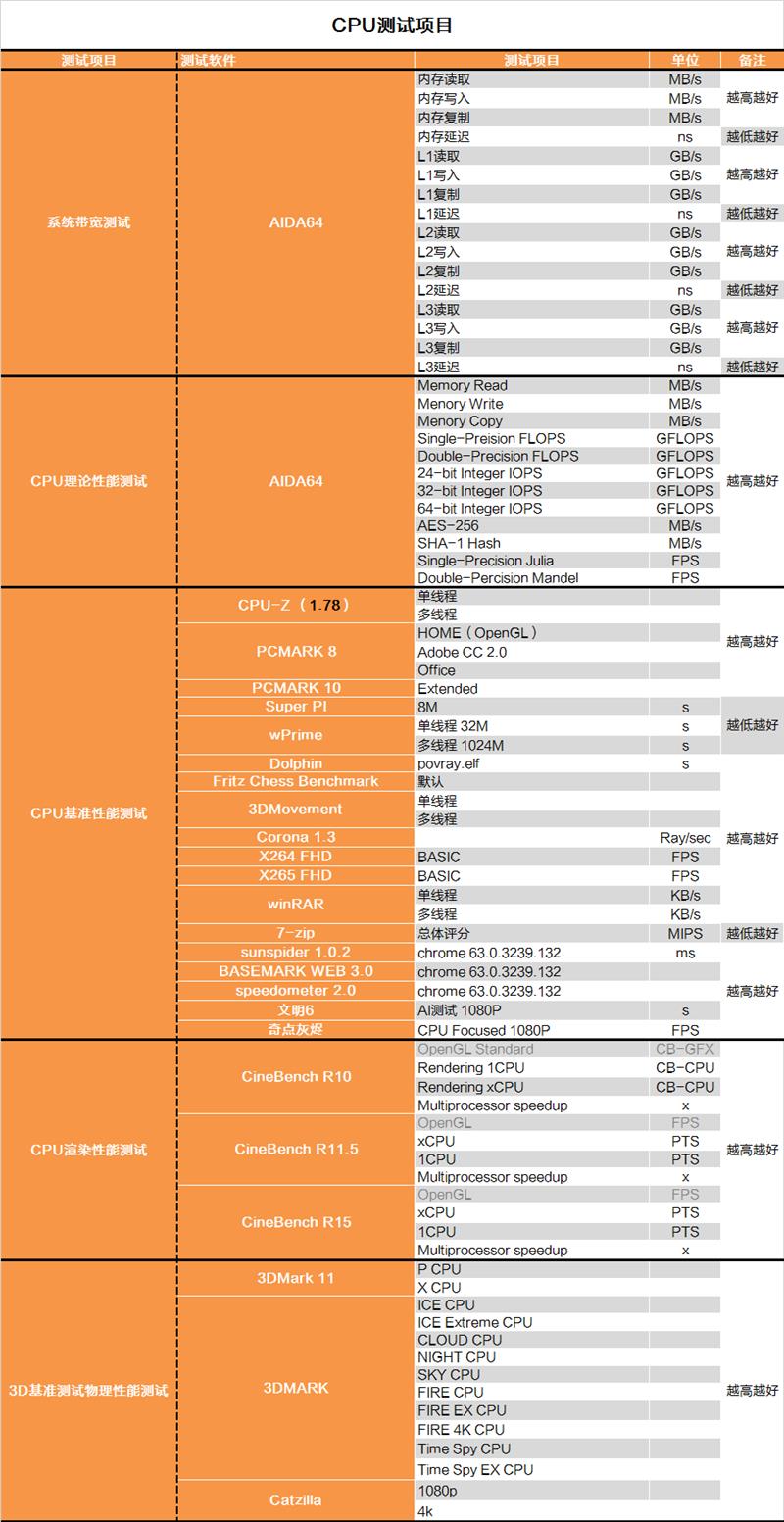

Introduction of performance test items:

For children’s shoes interested in further understanding the comparative performance, detailed test data will be provided here. If you don’t want to see it, you can skip to the last summary.

The test will be roughly divided into the following parts:

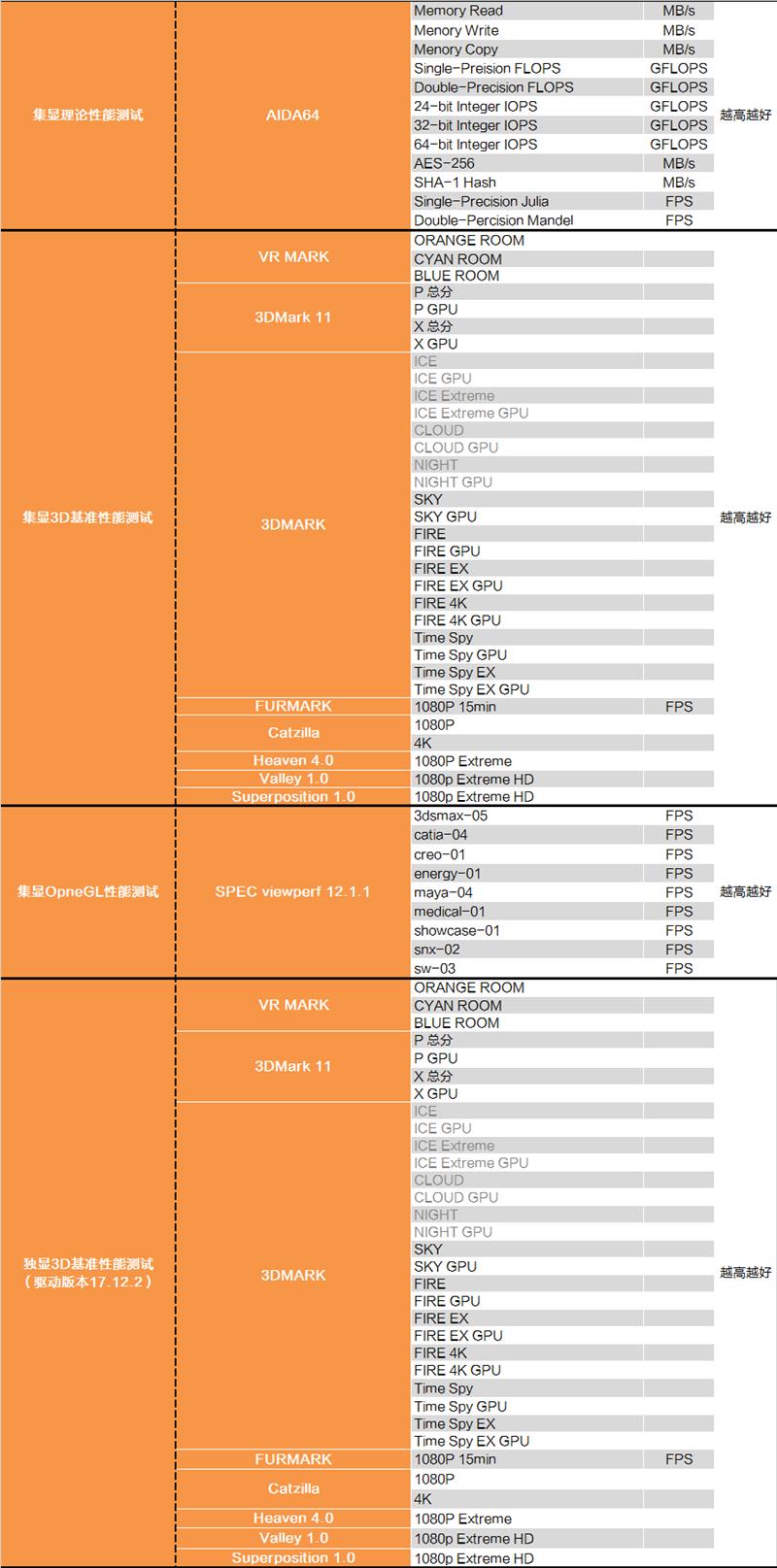

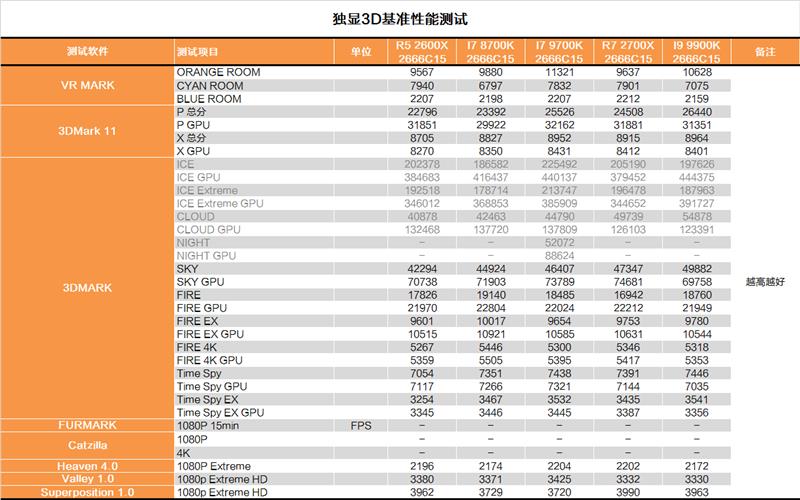

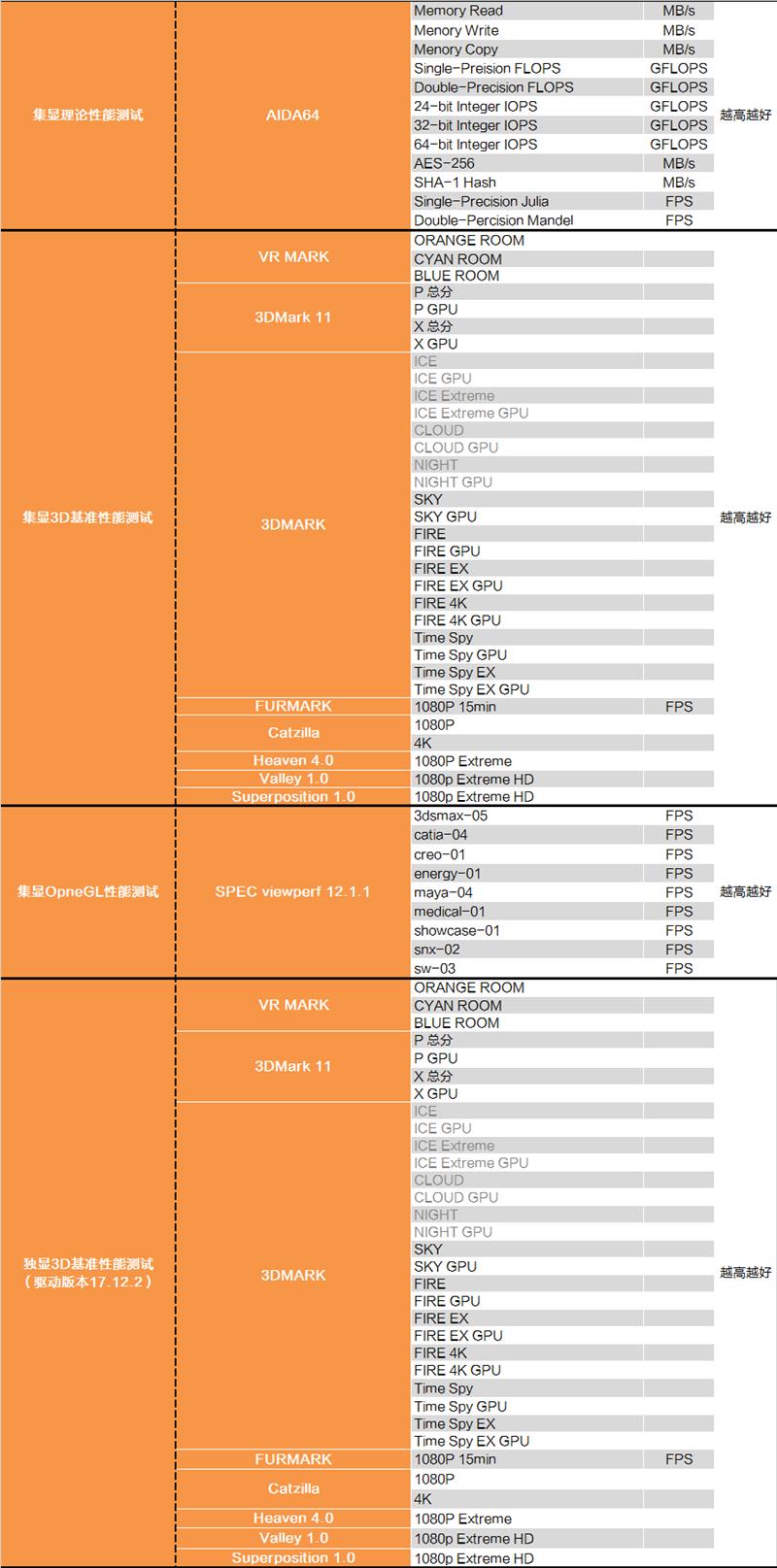

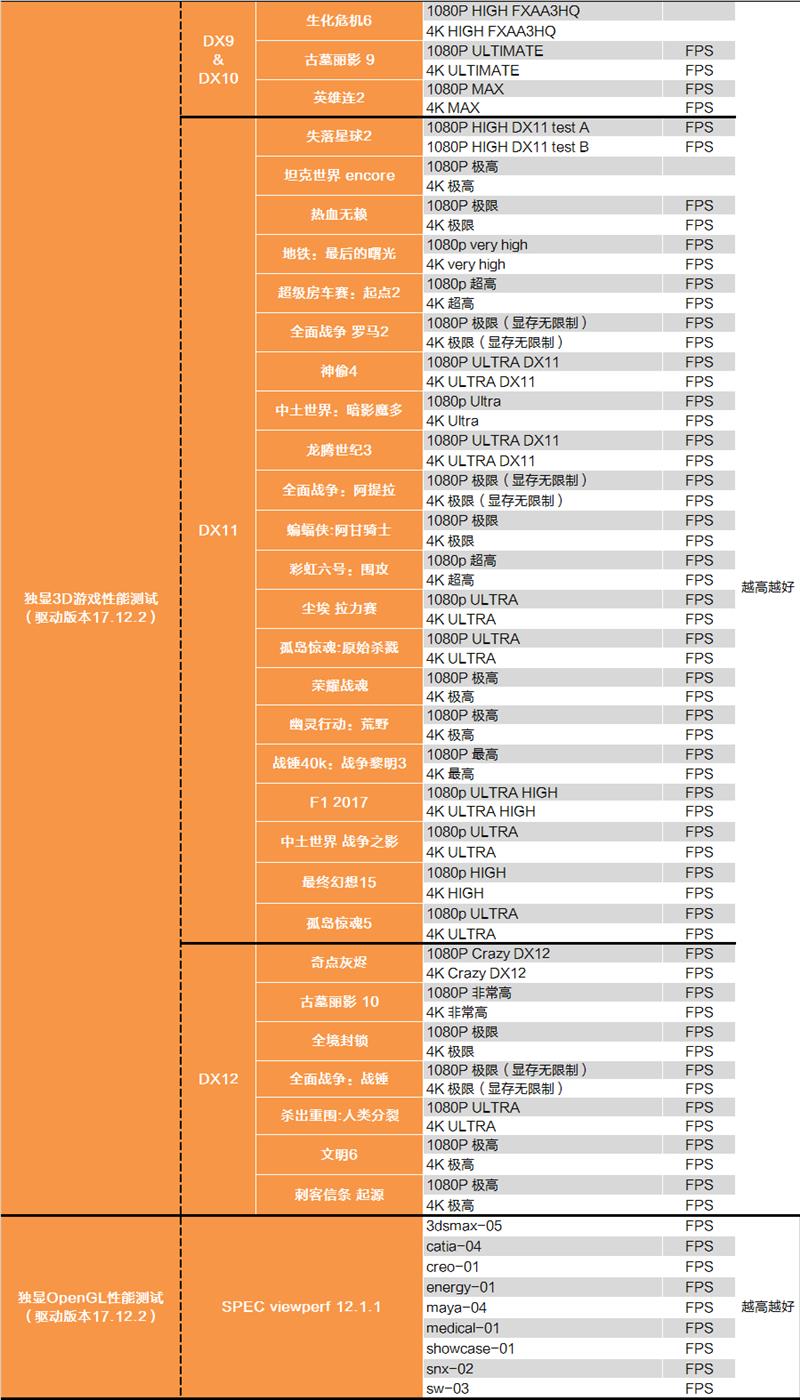

-CPU performance test: including system bandwidth, CPU theoretical performance, CPU benchmark test software, CPU rendering test software and 3DMARK physical score.

-Integrated graphics card test: including theoretical performance test, benchmark test software and professional software benchmark of integrated display.

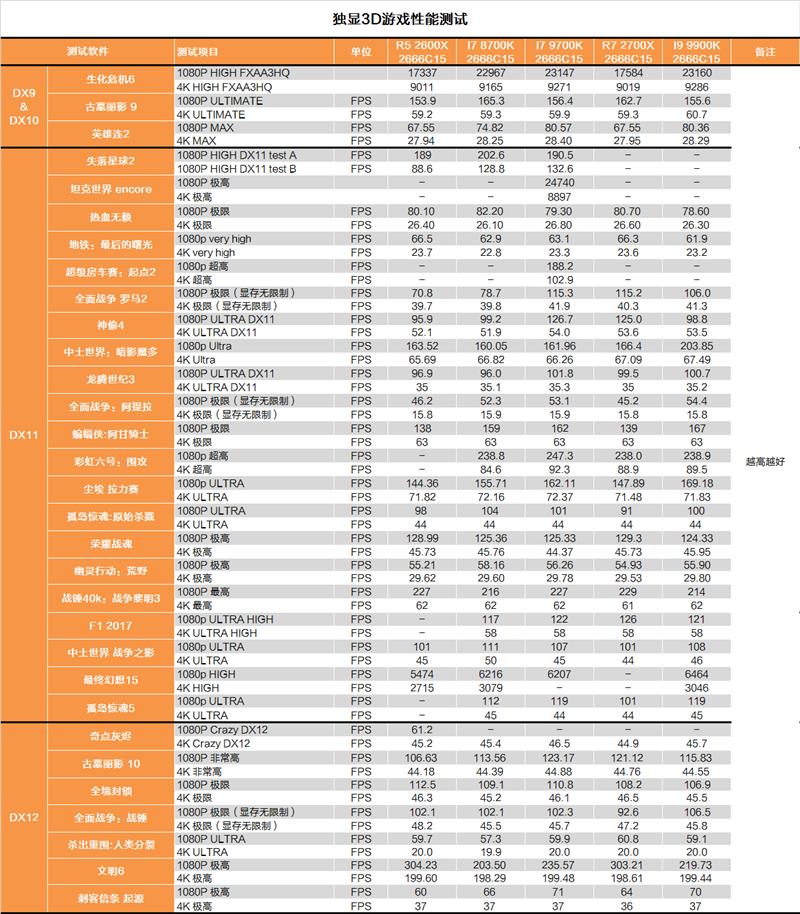

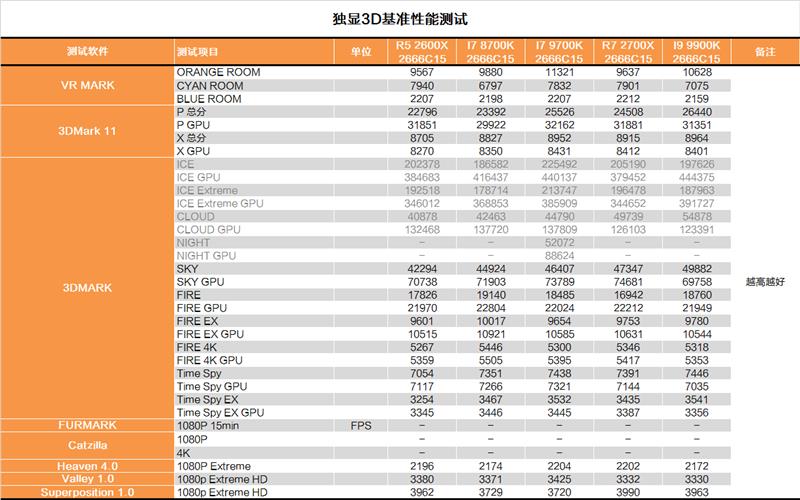

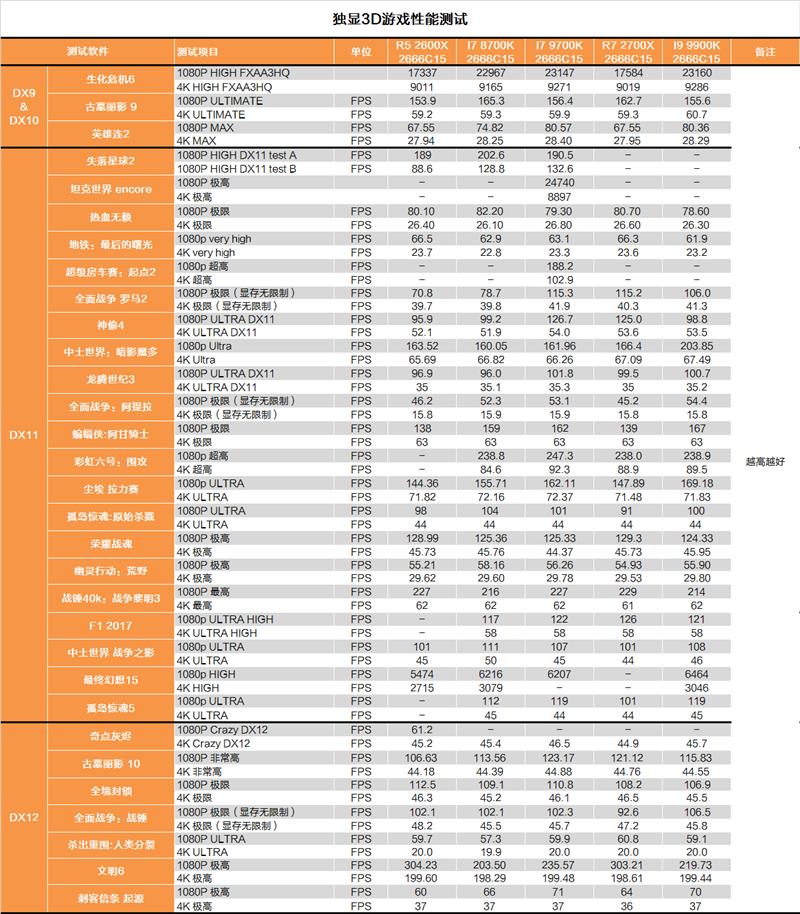

-Matching stand-alone test: including stand-alone benchmark test software, stand-alone game test and stand-alone professional software benchmark.

-Power consumption test: Power consumption is measured under the platform of centralized display and single display.

- Since this test, WBE3.0 and Android game simulator have been added, and the test items will be more and more abundant.

Performance test and analysis of CPU;

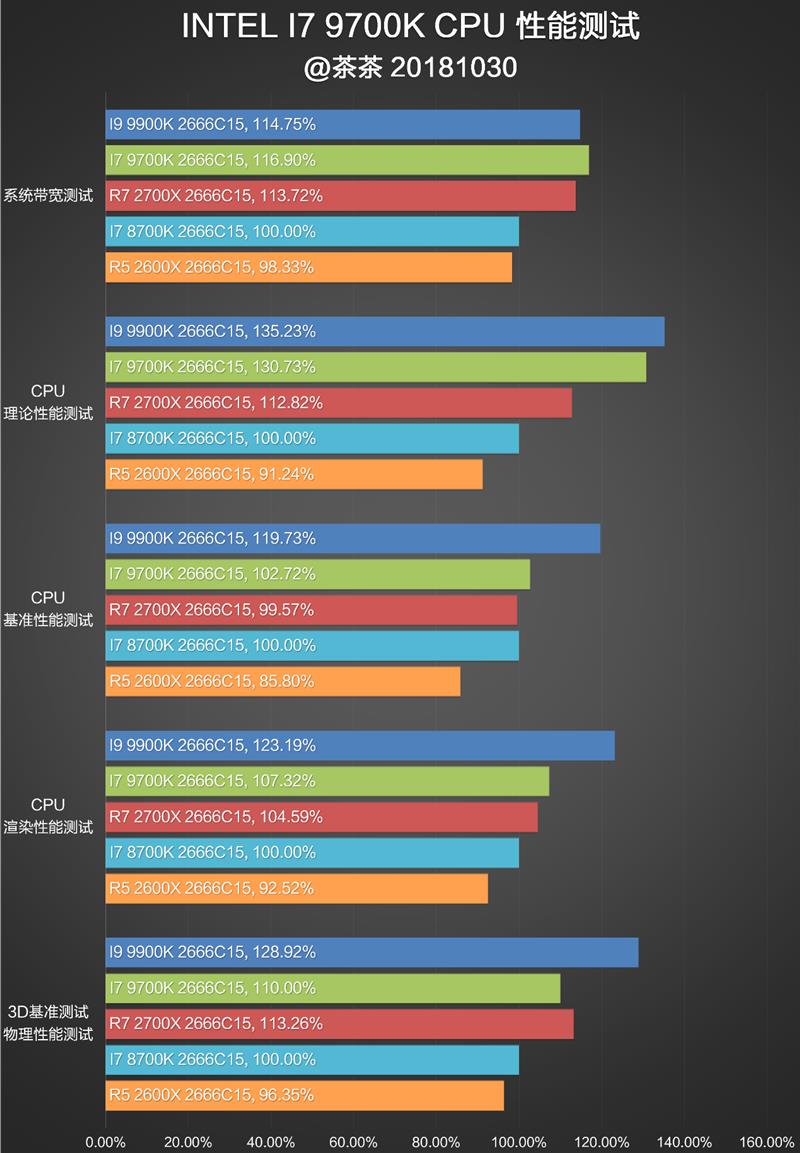

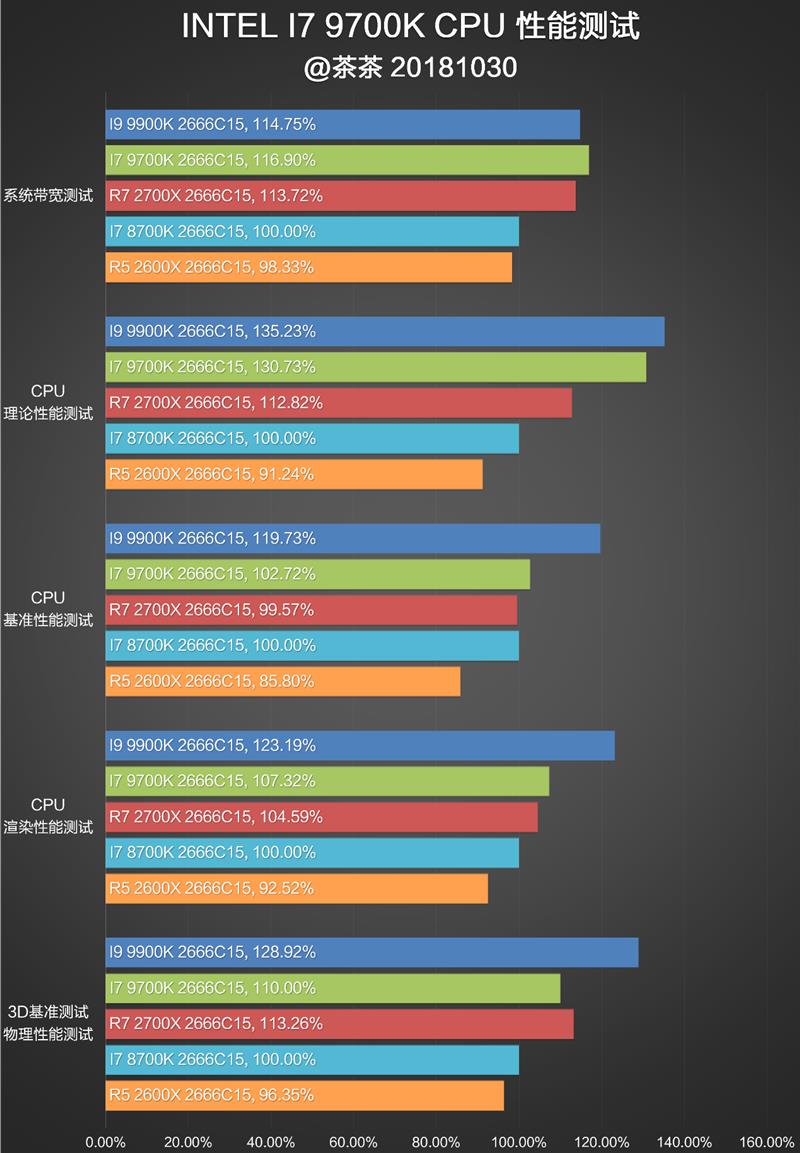

The system bandwidth test shows that the system bandwidth i9-9700K has been further improved, slightly lower than i9-9900K. Compared with i7-8700K, the improvement is mainly concentrated on L1 and L2, especially the bandwidth of L1 is increased by 40%. There is also a 10% improvement in the delay of L1L2.

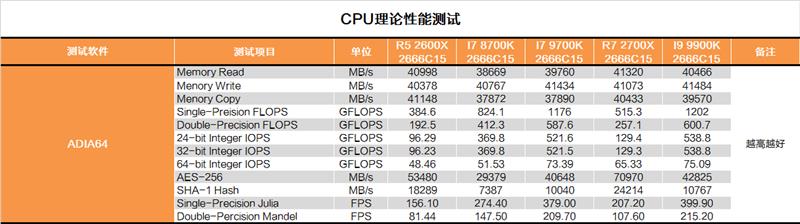

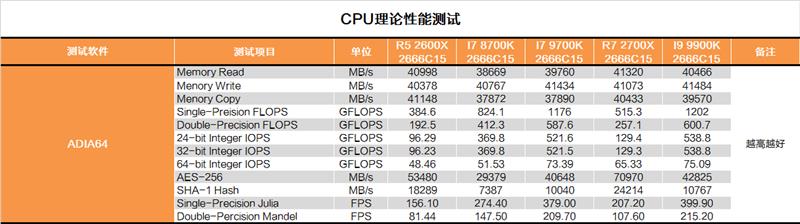

The theoretical performance test of CPU is carried out with the built-in tools of AIDA64. Excluding memory bandwidth, other computing power is improved by about 40% compared with i7-8700K.

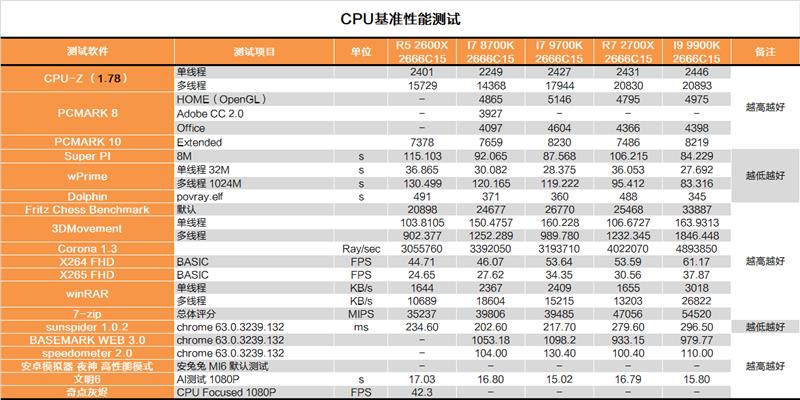

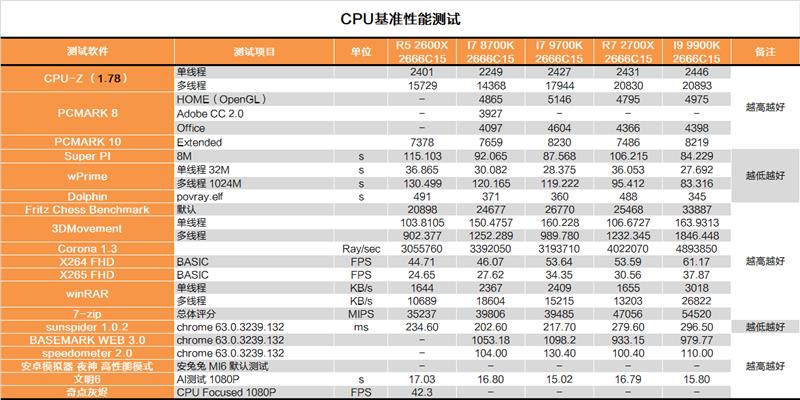

CPU performance test mainly tests some commonly used CPU benchmark software, and also includes some application software and CPU test items in the game. In this part, i7-9700K mainly has advantages in single-threaded testing, and can be close to i9-9900K. However, multithreading performance is relatively general, and some tests are not even as good as i7-8700K.

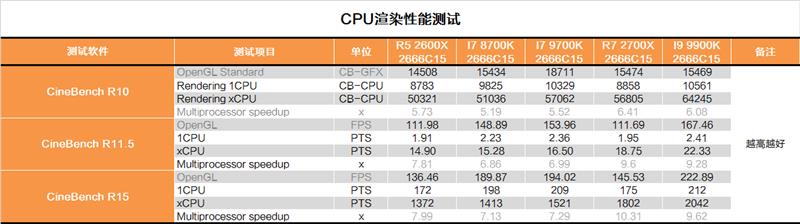

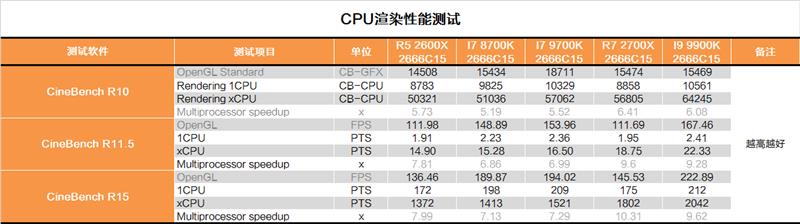

CPU rendering test, which tests the rendering ability of CPU.

The 3D physical performance test measures the physical scores in the 3DMARK test, which are mainly related to the CPU.

CPU performance test section comparison section:

According to the comprehensive statistics of CPU, i7-9700K and R7 2700X are basically on the same level, but there will be obvious gap with i9-9900K.

In fact, there is still a more tangled problem, that is, single thread and multi-thread, which has also been decomposed here.

-Single thread:Single thread is quite close to i9-9900K, about 5% behind and 5% stronger than i7-8700k.

-multithreading:Multithreading is a relatively weak part, which is about 35% behind I9-9900k, 8% behind R7 2700×8, and stronger than i7-8700K 4%.

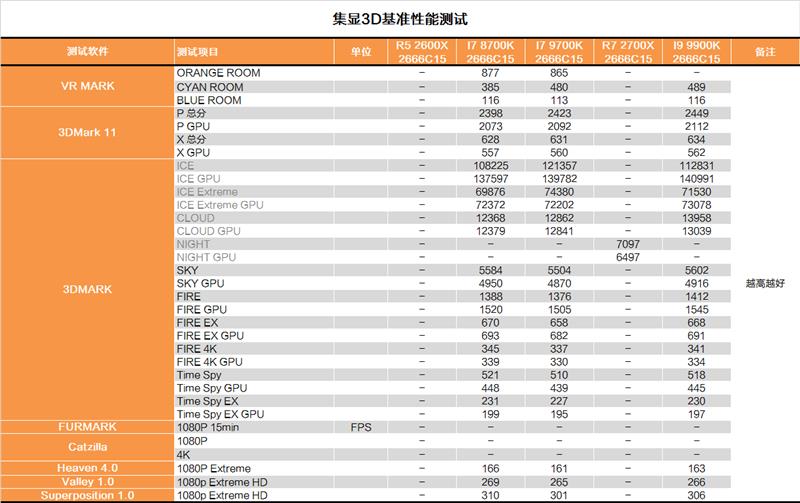

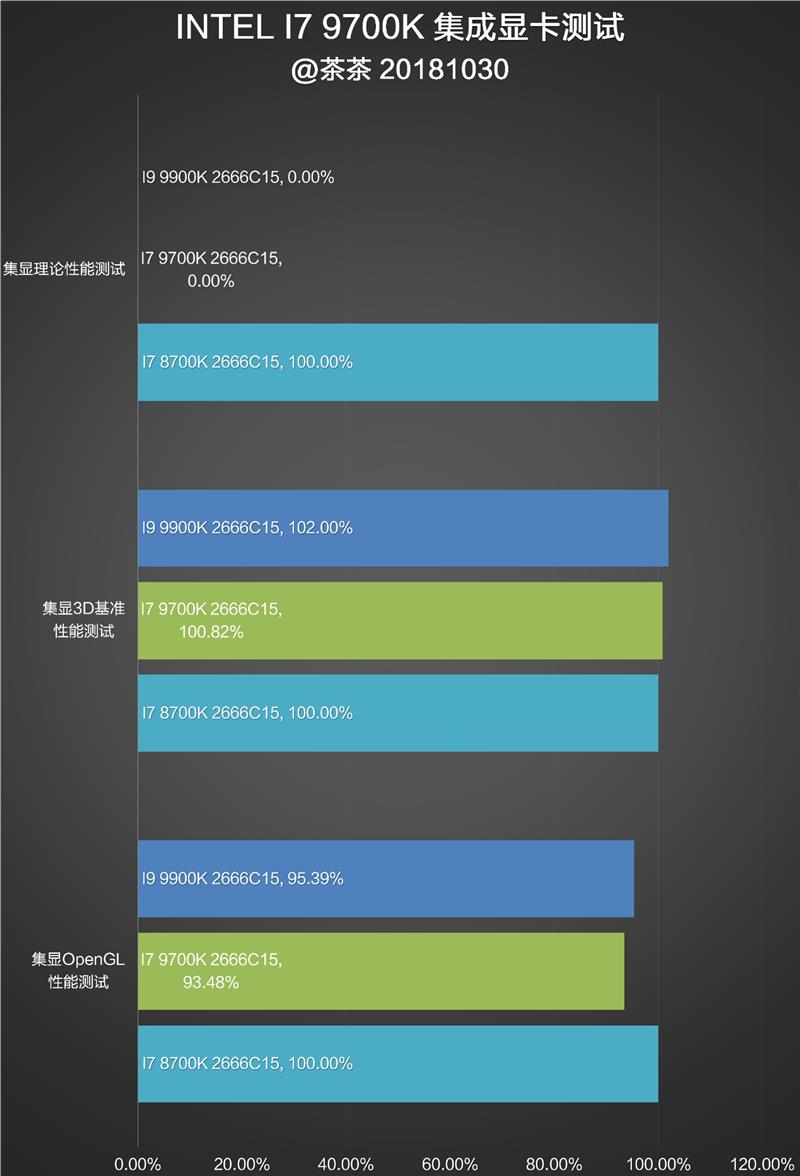

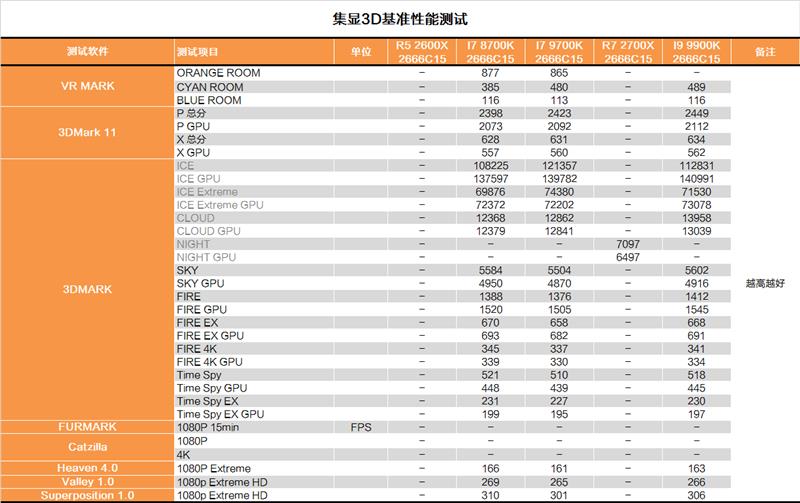

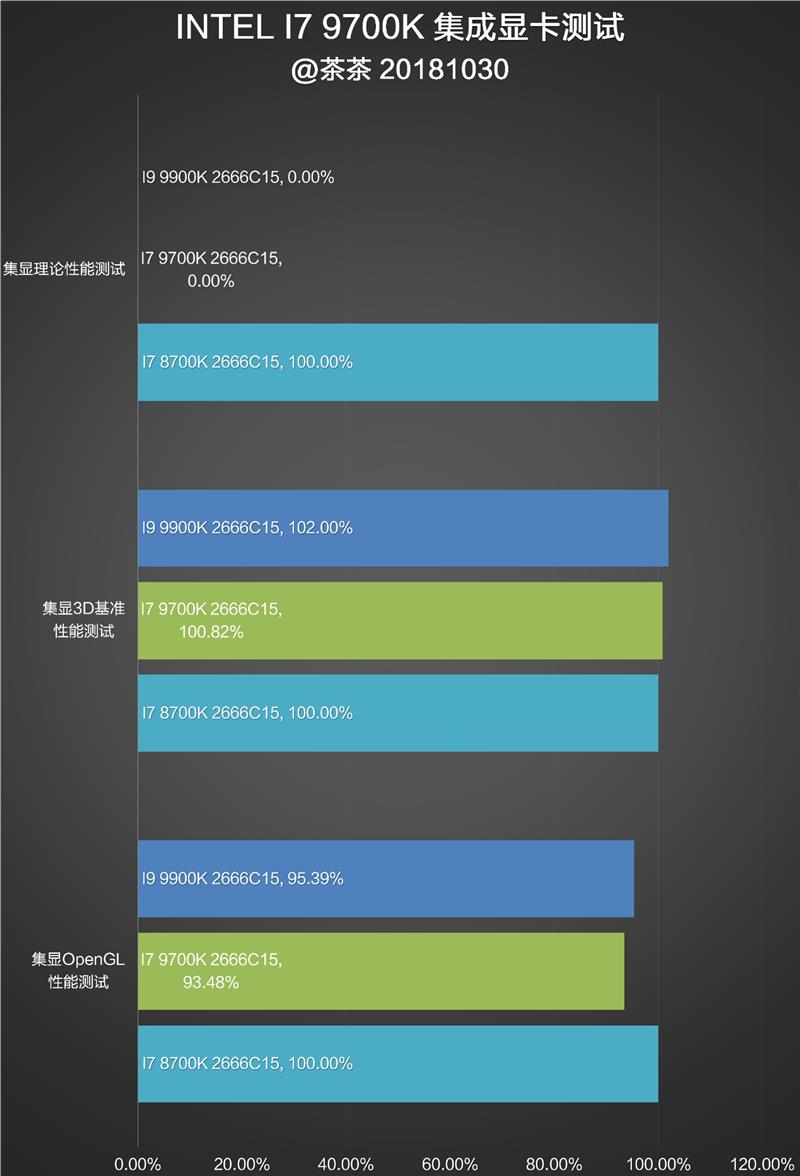

Set display performance test:

The theoretical performance test of centralized display is carried out with the built-in tools of AIDA64. Due to the compatibility problem between Intel’s integrated display driver and WIN10 of 1709, i7-9700K did not collect data for integrated display 3D benchmark test, and mainly ran some benchmark test software.

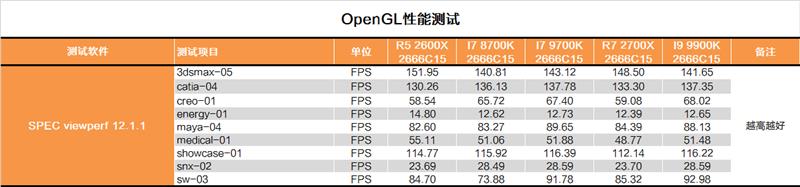

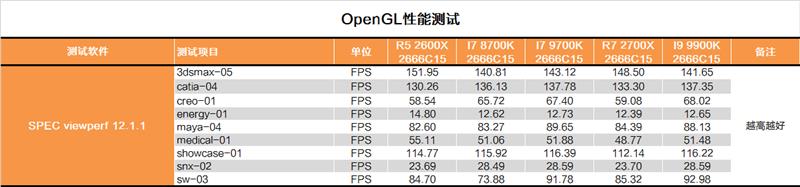

Set display OpenGL benchmark test, and the professional software part is based on SPEC viewperf 12.1.

Set display performance test section:

Since the centralized display of i7-9700K is the same as that of i7-8700K, there is no substantial difference.

With a stand-alone test:

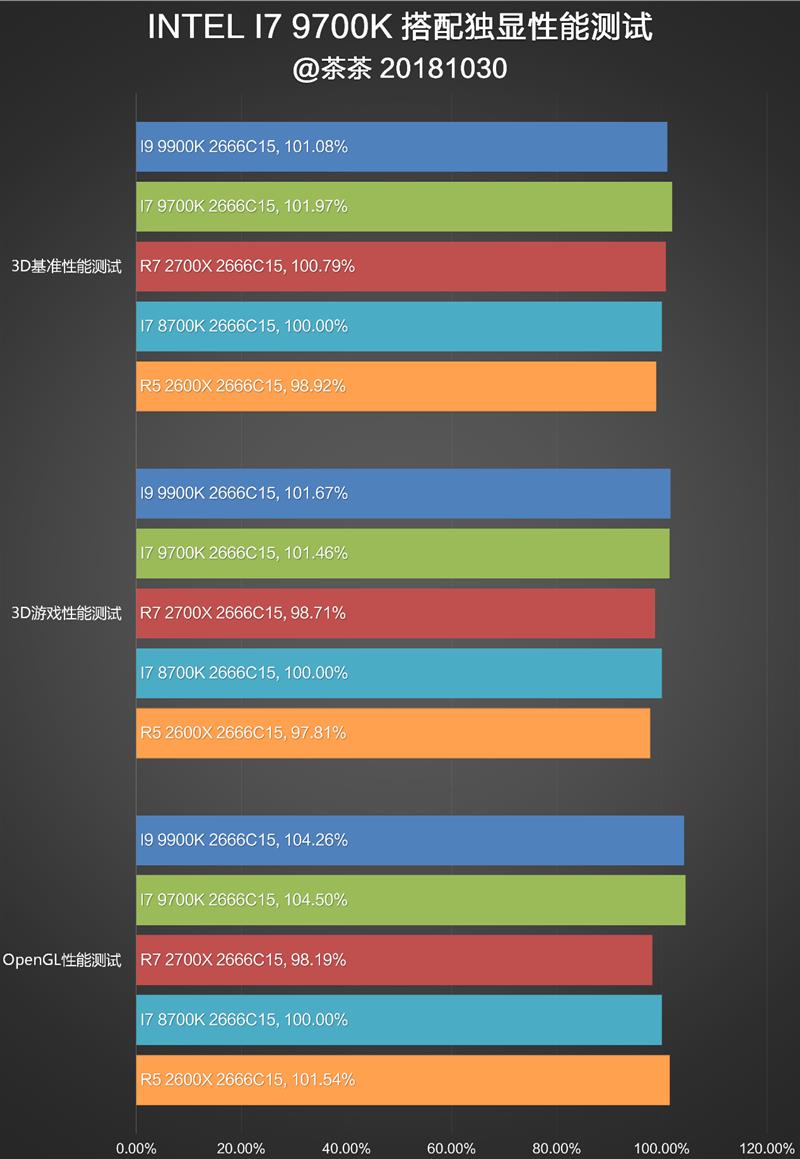

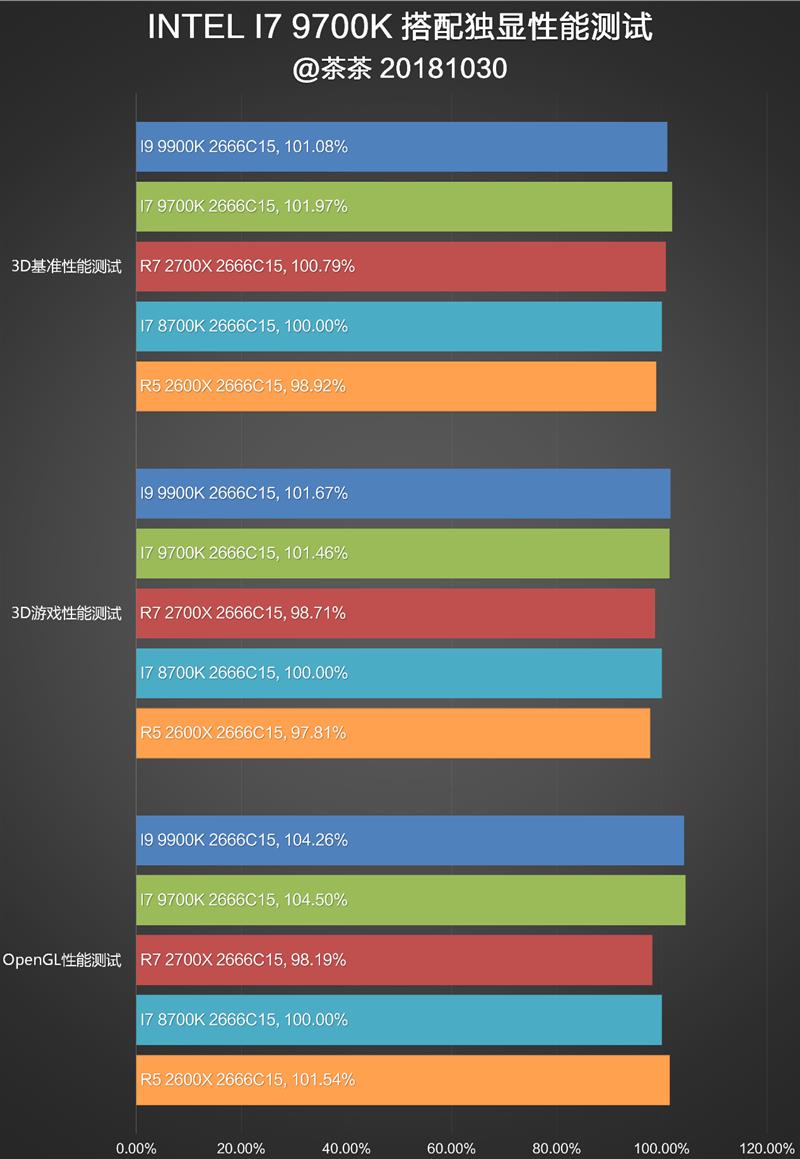

The graphics card is VEGA 64. Simply running i7-9700K is the highest, but the advantage is weak.

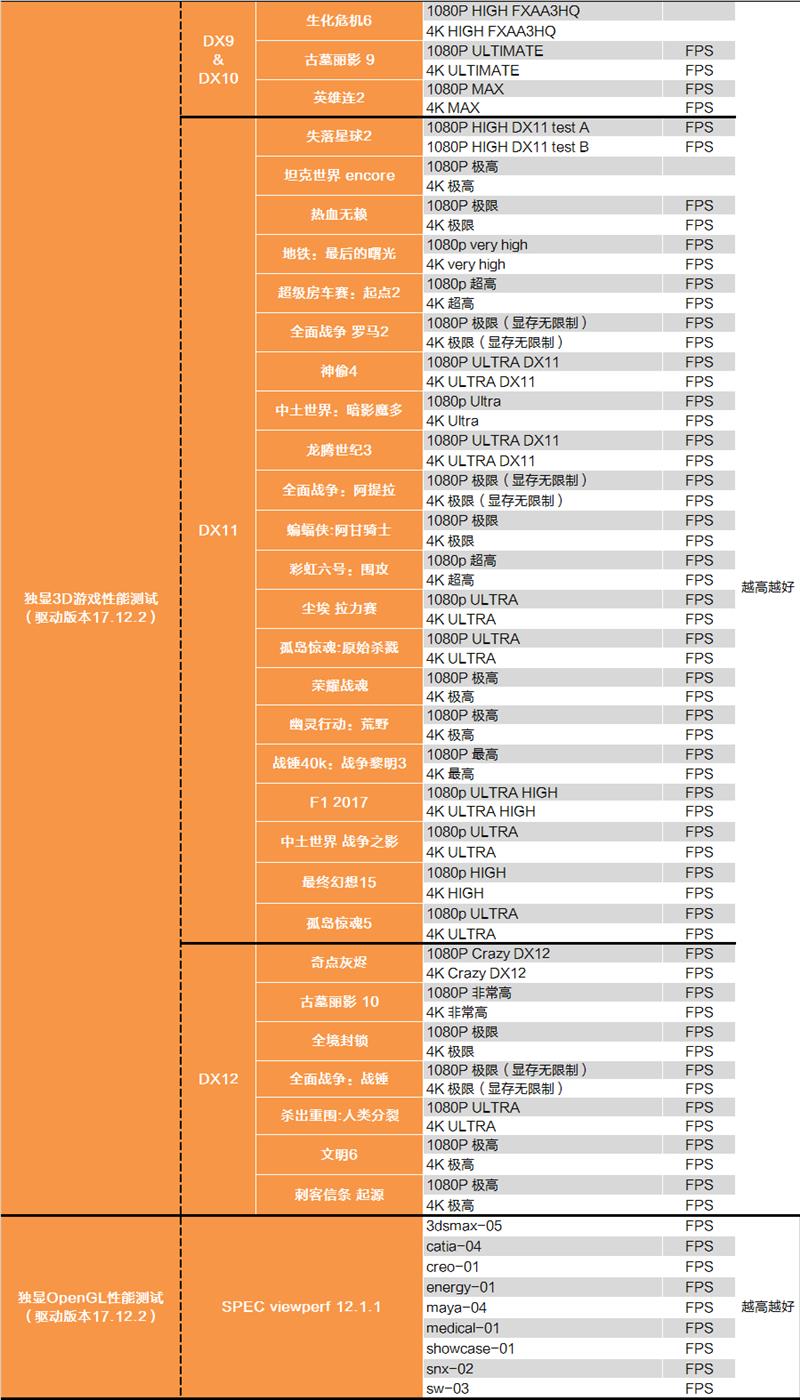

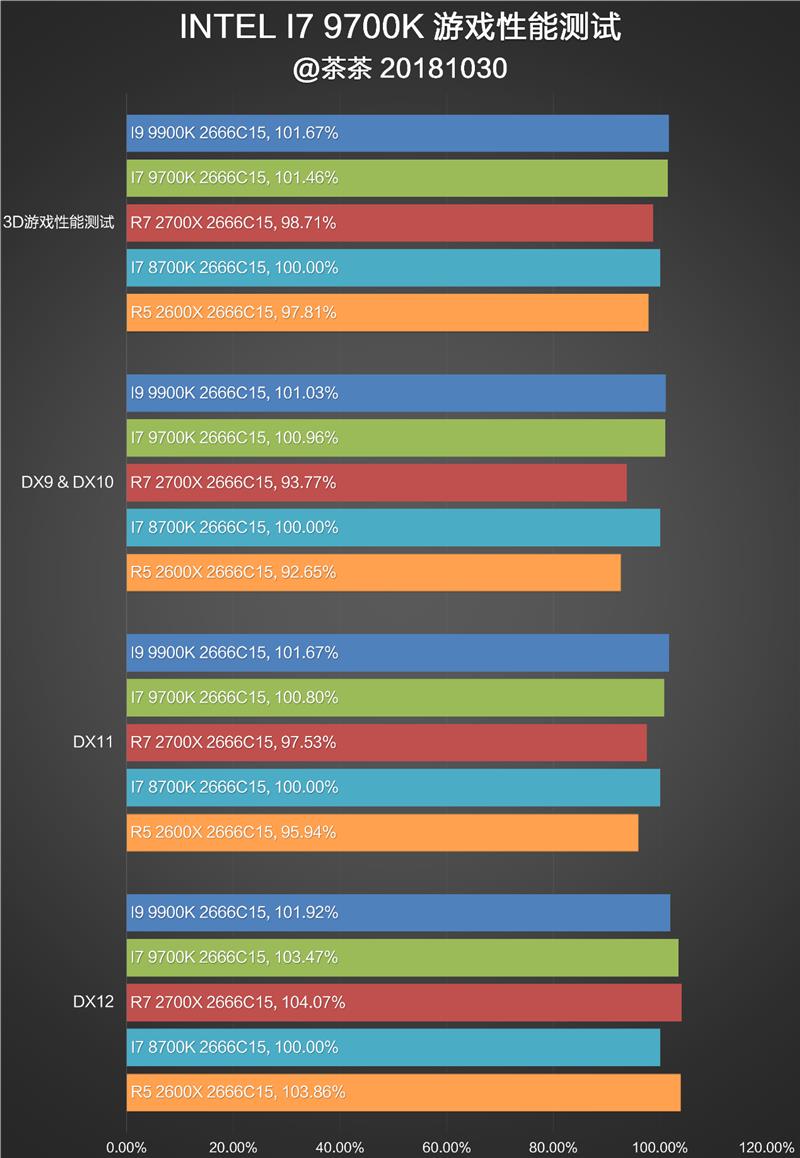

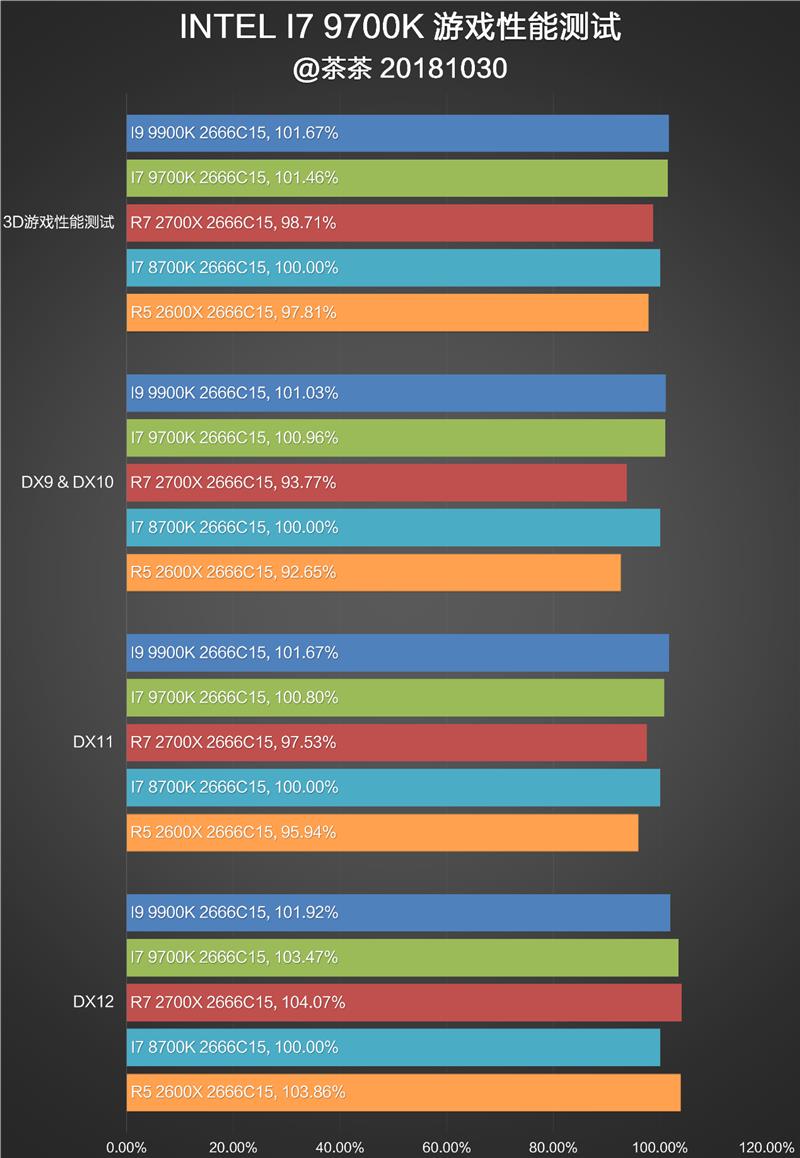

Unique 3D game test, i7-9700K will be slightly weaker than i9-9900K in the game test.

In terms of each generation, i7-9700K has a slight advantage over i9-9900K in DX9 & DX11, slightly weaker than i9-9900K in DX11, and has a great advantage in DX12, with the greatest advantage over i9-9900K.

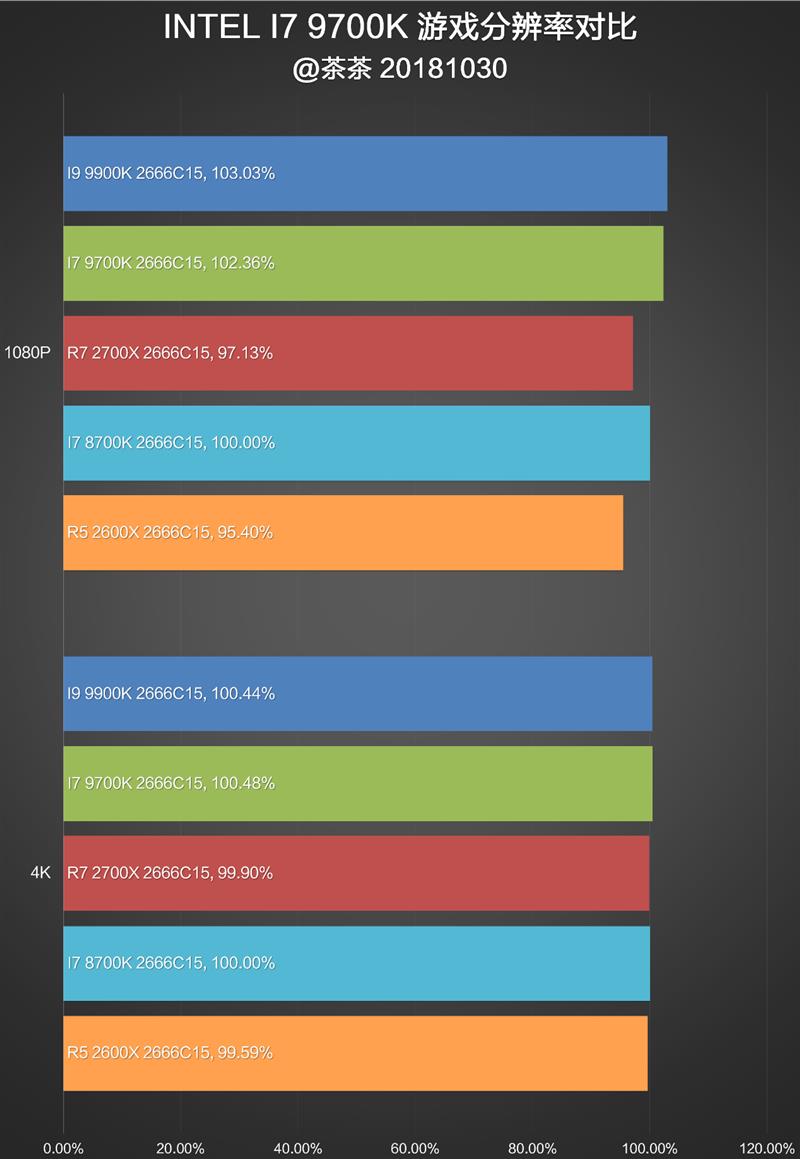

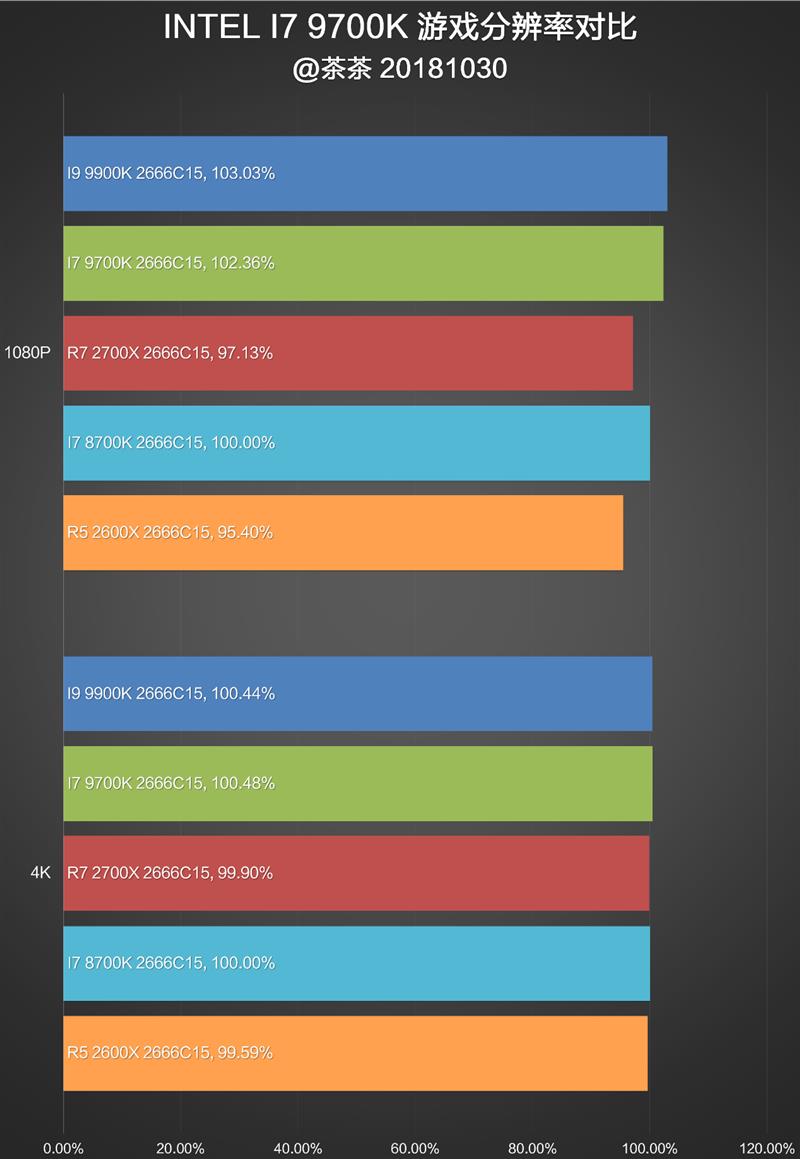

There has always been a big controversy about the resolution in game testing, so I’ll break it down directly here. Because DX11 games account for more than half of my testing, it seems that i7-9700K will be slightly weaker than i9-9900K at both resolutions, but it will be significantly stronger than R7 2700X at 1080P.

OpenGL benchmark test alone. The OpenGL part is based on SPEC viewperf 12.1. This test is a professional operation test for graphics cards, and the gap is more related to CPU single thread.

With a separate test section:

According to the test results, the i7-9700K is quite close to the i9-9900K, which directly throws off other CPUs.

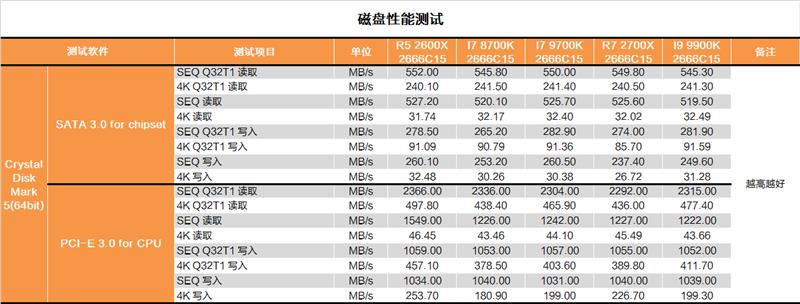

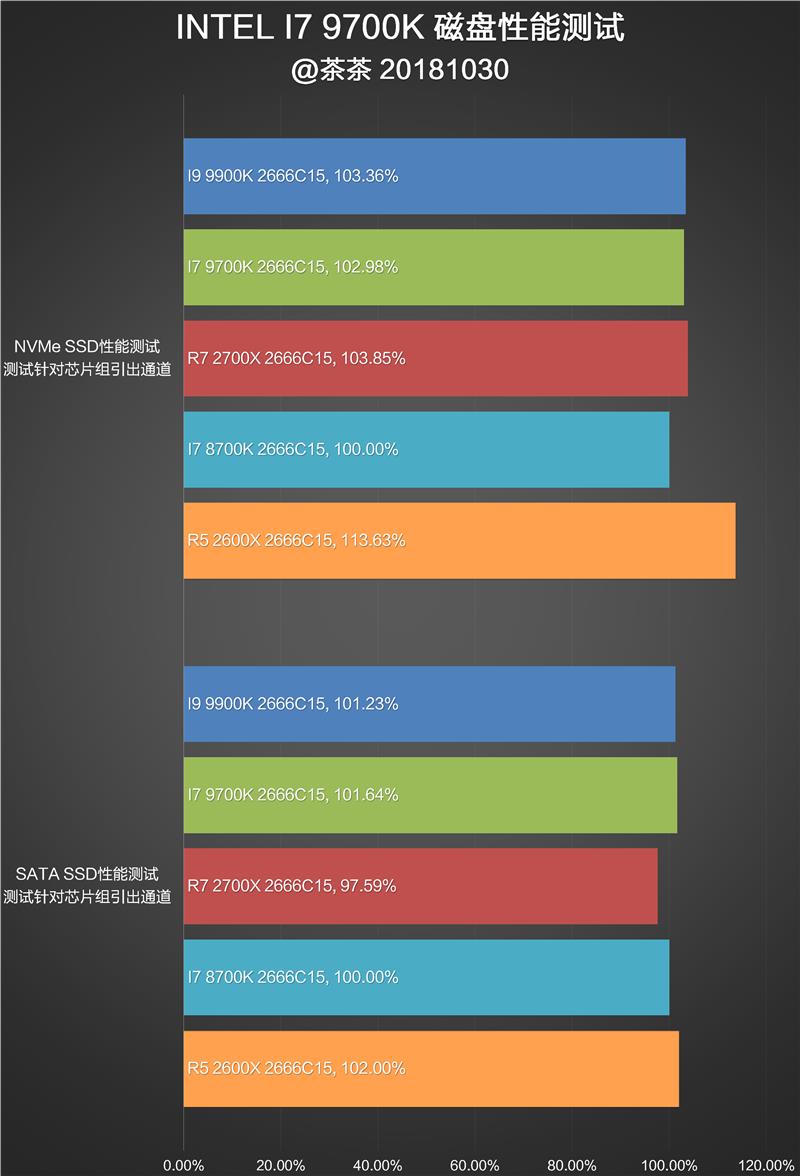

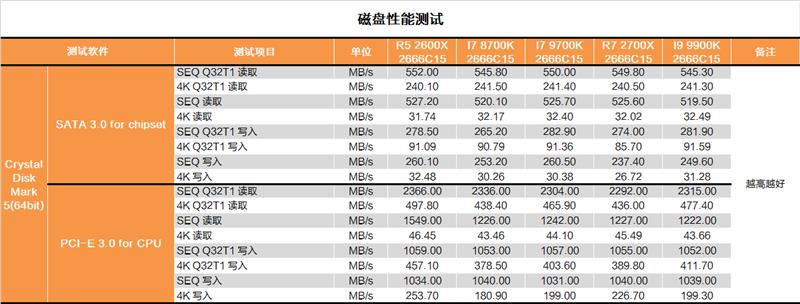

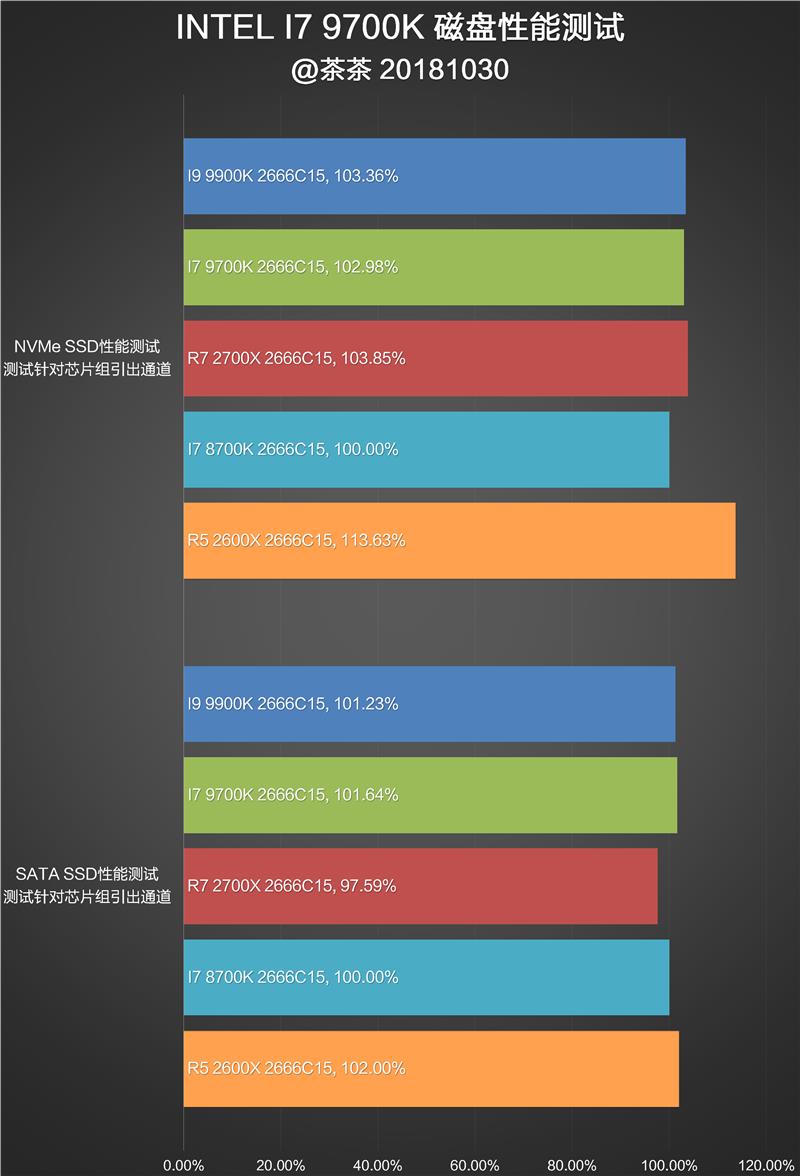

Disk performance test:

The disk test part uses CrystalDiskMark 5,1g data file to run 9 times, which can basically eliminate the test error. The tested SSDs are 535 480G and 750 400G, both of which are hung from the disk. Simply explain the concept in this test, SATA interface and PCI-E channel can be drawn from CPU or chipset (see how CPU manufacturers design). Here, for the sake of unification, all the tests are SATA from chipset and PCI-E from CPU.

Judging from the test results, i7-9700K is roughly equivalent to i9-9900K, and R5 2600X is relatively high in NVMe test mainly because some specific vulnerabilities are not fixed. Please refer to R7 2700X.

Platform power consumption test:

In terms of power consumption, the power consumption control of i7-9700K will be better. In the most extreme case, it is 40W more than i7-87000K, which is within the controllable range.

With the unique display, the overall power consumption of i7-9700K will be between i7-8700K and R5 2600X, which is well controlled.

Detailed statistics:

Summary of test results:

The comparison groups in this test are i9-9900X, R7 2700X, i7-8700K and R5 2600X. All products are close to the current positioning or price of i7-9700K.

Because the performance test environment of CPU has been changing dynamically (system, BIOS, driver), i9-9900K, i7-8700K and R7 2700X have been tested completely. The testing time of R5 2600X is in April 2018.

AMD RYZEN has undergone some changes after updating the BIOS and drivers. The problem of memory copy performance degradation found in the initial test of B450 has been fixed, but at the cost of CPU power consumption increase and NVME disk performance decline. Therefore, it can be confirmed that AMD’s microcode in 1.0.0.4 recently corrected some Spectre vulnerabilities. Overall, the CPU performance is basically unchanged (increased by 0.5%), and the NVMe performance is reduced by 5%. In the release test, the problem of current limiting of R7 2700X baking machine has also been solved, so the power consumption of R7 2700X will be revised and increased by about 15%.

As far as the performance of CPU is concerned, it is quite interesting.After synthesizing various usage scenarios, the i7-9700K and R7 2700X are on a par. Relatively speaking, the single-threaded performance of i7-9700K is more advantageous, while the multi-threaded performance of R7 2700X is more advantageous.

As far as the performance of Jixian is concerned, there is nothing to say because Jixian has not been updated.

With the unique part, the i7-9700K has become the strongest one without any accident, but it has not opened the decisive gap.

In terms of power consumption,I7-9700K is more balanced, a little higher than i7-8700K, and there will be no out-of-control situation like i9-9900K.

Here is a screenshot of the baking machine. i7-9700K can stably bake the FPU project of AIDA 64 in 4.6G.

Finally, the last horizontal comparison table is for your reference.

The performance part only compares the test items related to CPU, and does not include the results of the game performance test. Because the graphics card has been changed in the middle and the memory frequency has changed to some extent, this table can only be used for general reference for the time being. In the table, the results of previous tests (different graphics cards) are not included, and only the test results that are not affected by the graphics card are extracted. In the horizontal test, it is found that R7 2700X is slightly higher than i7-9700K. This is because the benchmark in the previous test is i7-8700K, and the reference benchmark in the horizontal test is i7-7700K all the time, so the CPU with a particularly close performance gap will be affected by the benchmark change, and its ranking will change.

Simple summary:

About CPU performance:

As far as CPU performance is concerned, i7-9700K is quite good by itself. Single-thread performance ensures the fluency of daily software use, and multi-thread performance reaches the level of i7-8700K.

On the performance of centralized display:

The display of i7-9700K has not been updated, so there is no change. With regard to the unique display: In the case of unique display, i7-9700K and i9-9900K are quite close, and they sit firmly in the first group, but relatively speaking, the influence of CPU on game performance is really not great, and there is no substantial difference above six cores.

About power consumption:

The power consumption control of i7-9700K is quite reasonable, even if the FPU is baked alone, it will not roll over. It seems that high frequency+hyper-threading is a poison to AVX instruction set. Accordingly, the B360 motherboard with solid power supply can be considered in the matching of i7-9700K, which can greatly reduce the budget of the whole machine. The motherboard suggests that the power supply of the CPU core should be greater than or equal to 6 phases.

About overclocking:

Because the power consumption control of i7-9700K is much better than that of i9-9900K, it should be easier to achieve super 5G.

Generally speaking, the performance of i7-9700K is relatively excellent, both single-threaded and multi-threaded. However, compared with other products in the market, the biggest embarrassment is that it can’t open the gap with R7 2700X, but there is a big gap in price. The boxed price difference in JD.COM exceeds that in 1000 yuan.

I7-9700K and R7 2700X are just two CPU optimization directions, i7-9700K has advantages in single thread, R7 2700X has advantages in multi-thread, and the two on the other end are also completely qualified, so in the use scenarios of these two CPUs, single-thread performance will be more important. If the price difference between i7-9700K and R7 2700X is below 15%, then i7-9700K will have obvious purchase value.